Shares of easyJet company symbol: LON:EZJ has increased 4.14% or 28.2 points during today’s session so far. Market buyers have stayed positive during the session. Range high for the period has seen 721 and a low of 685.4. The volume total for shares traded up to this point was 2,673,136 whilst the average number of shares exchanged is 7,630,615. The stock 52 week high is 921.89 which is 241.29 points difference from the previous close and the 52 week low at 385.43 is a variance of 295.17 points. easyJet has a 20 SMA of 662.48 and now its 50 day moving average now of 690.52. The market capitalisation is now £5,372.77m at the time of this report. The currency for this stock is GBX. Market cap is measured in GBP. This article was written with the last trade for easyJet being recorded at Monday, September 27, 2021 at 12:36:35 PM GMT with the stock price trading at 708.8 GBX.

Shares in Egdon Resources with company EPIC: LON:EDR has moved up 11.67% or 0.17 points throughout today’s trading session so far. Market buyers have remained positive during the trading session. Range high for the period so far is 1.8 while the low for the session was 1.44. The amount of shares exchanged has so far reached 3,039,247 with the daily average at 2,472,221. The stock 52 week high is 2.59 some 1.09 points in difference to the previous days close of business and a 52 week low sitting at 1.13 which is a variance of 0.37 points. Egdon Resources now has a 20 SMA at 1.45 with a 50 day moving average now at 1.4. The current market cap is £8.66m at the time of this report. Share price is traded in GBX. Mcap is measured in GBP. This article was written with the last trade for Egdon Resources being recorded at Monday, September 27, 2021 at 12:18:32 PM GMT with the stock price trading at 1.68 GBX.

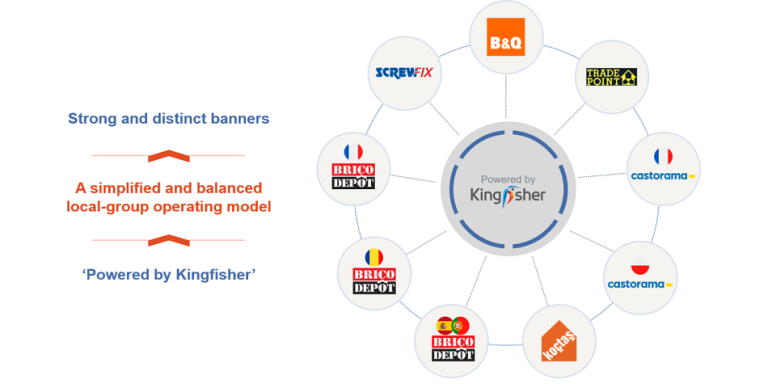

The stock price for Kingfisher with company EPIC: LON:KGF has climbed 1.63% or 5.6 points throughout the session so far. Market buyers seem confident while the stock has been in play. The period high was 349.6 dropping as low as 343.9. The volume total for shares traded up to this point was 1,435,594 with the average number of shares traded daily being 5,446,210. The 52 week high is 389.67 which is 46.17 points different to the previous business close and a 52 week low sitting at 259.5 which is a difference of 84 points. Kingfisher now has a 20 SMA at 358.43 with a 50 day MA at 364.35. This puts the market cap at £7,371.29m at the time of this report. The currency for this stock is GBX. Market cap is measured in GBP. This article was written with the last trade for Kingfisher being recorded at Monday, September 27, 2021 at 12:37:20 PM GMT with the stock price trading at 349.1 GBX.

Shares of KRM22 found using EPIC: LON:KRM has gained 4.67% or 1.4 points during today’s session so far. Investors have remained optimistic during the trading session. Range high for the period so far is 31.4 and hitting a low of 31.4. The total volume of shares traded by this point was 5,000 while the average shares exchanged is 14,186. A 52 week high for the stock is 54 about 24 points different to the previous business close and a 52 week low sitting at 22 which is a difference of 8 points. KRM22 has a 20 SMA of 28.65 and a 50 day moving average at 30.96. The current market cap is £8.40m at the time of this report. The share price is in Great British pence. Mcap is measured in GBP. This article was written with the last trade for KRM22 being recorded at Monday, September 27, 2021 at 10:50:18 AM GMT with the stock price trading at 31.4 GBX.