Energean Oil and Gas plc (LON: ENOG), the independent gas and oil exploration and production company focused on the Mediterranean, announced today its half-year results for the half year ended 30 June 2019.

Mathios Rigas, Chief Executive, Energean Oil & Gas commented:

“We are on track and on budget to deliver first gas from the Karish Tanin development in Q1 2021 having delivered key milestones in the project, discovered more gas to monetise through the successful Karish North well as well as making good progress elsewhere across the portfolio. The Edison transaction announced in July is on track to complete before the end of this year, at which point Energean will become a company of considerable scale in the Mediterranean with pro-forma 2P reserves of 639 mmboe, weighted 80% towards gas, further enhancing our energy transition strategy. With the addition of the Edison portfolio, Energean now has a significant number of new investment opportunities and, as part of the integration process, we are reviewing all capital allocation options to ensure that investment is prioritised towards those projects which offer the highest returns. We look forward to a busy second half to what has so far been a very successful and transformational year at Energean.”

Highlights

· Acquired Edison E&P for $750 million of up-front consideration, representing headline metrics of $2.6 /boe and 1.7x 2018 EBITDAX, and adding immediate cash flows, EBITDAX and incremental growth opportunities. Contingent consideration of $100 million is payable following first gas from Cassiopea (expected 2022)[1]

· Raised $265 million of equity and $600 million of bridge financing to fund the acquisition. Long-term reserve-based lending facility take-out of the bridge financing is ongoing and expected to complete in 4Q1

· The acquisition remains on track to complete before 2019 year-end

· Upon completion pro-forma 2P reserves will be 639mmboe (c.80% gas) and pro-forma 2022 production will be c. 140,000 boepd (c. 80% gas)

· Karish and Tanin development on budget and on track for first gas in Q1 2021

· Significant gas discovery at Karish North with a higher-than-expected liquids content

· Completed the drilling of two of the three Karish development wells, confirming a 45m gas column in the D sands and a higher-than-expected liquids content in the main C sand reservoir

· 4. 7 bcma of gas sales contracted, leaving 3.3 bcma FPSO capacity for future discoveries. Term sheet agreed with Mrc Alon Tavor Power Ltd., the winning bidder of the Alon Tavor tender

· Initiated a capital allocation review across the enlarged portfolio, in order to prioritise investment towards those projects that deliver the highest stakeholder returns

· Awarded four new, highly prospective licences in the Israeli EEZ

· Completed drilling of the second Epsilon vertical well, which indicated increased oil in place and reinforced Epsilon as the driver of production growth in Greece

· At 30 June 2019, Energean had cash and undrawn debt facilities of $1.01 billion[2]

| 1H 2019$m | 1H 2018$m | Change | |

| Sales revenue | 40.0 | 26.3 | 52.1% |

| Operating profit | 3.9 | 10.2 | (62.2%) |

| Profit / (loss) before tax | (3.1) | 82.1 | (103.8%) |

| Adjusted EBITDAX[3] | 23.6 | 16.7 | 41.1% |

| Operating cash flow[4] | 23.7 | 16.9 | 39.9% |

| Capital expenditure | 346.9 | 105.5 | 228.9% |

| Cash capital expenditure[5] | 541.4 | 136.4 | 296.9% |

| Net debt / (cash) | 390.4 | (166.5) | (334.4%) |

4Q19 Outlook

· Completion of the acquisition of Edison E&P

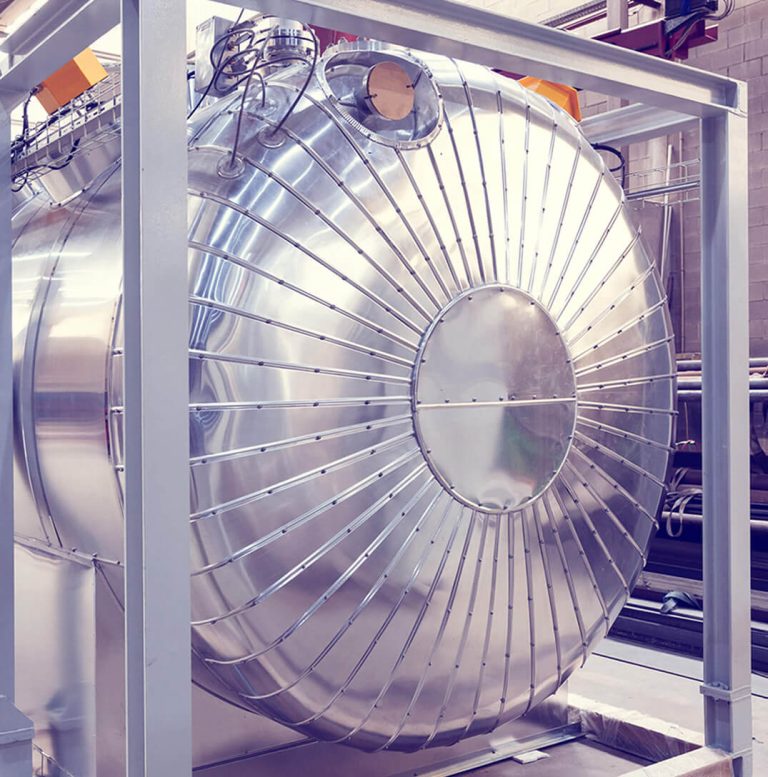

· Sailaway of the Energean Power FPSO hull from China to Singapore for integration of the topsides

· Completion of the Karish Main development drilling programme

· Appraisal of Karish North with the intention of narrowing the resource range and further defining the liquids content

· NSAI CPRs to define the upside volumes associated with the Epsilon Deep and Dolomitic Zones and Katakolo development project

· 2019 Full Year production guidance of 3,400 – 3,600 bopd (previously 4,300 – 4,800 bopd). Early conclusions from the capital allocation review resulted in the smart stacking of the Energean Force, halting Prinos infill drilling and focusing near-term investment on interventions, workovers and the high-return Epsilon accumulation

· 2019 development and production capital expenditure guidance reduced by $40 million, driven by the revised investment programme in Greece