CyanConnode Holdings plc (LON:CYAN) FY’21 results were ahead of market expectations, with all financial metrics showing a sharp improvement. YoY revenue growth was 163%, while the EBITDA loss reduced sharply, by 62%. During the year, contracts were signed for in excess of 350,000 modules, while a flurry of new contracts have been signed since end-March. Activity levels relating to the immense planned rollout in India are growing, while other regions (South East Asia, Africa) are starting to exhibit material contract momentum. In this note, we also briefly explore the water meter opportunity. Our updated DCF-implied fair equity value for CyanConnode is £90m.

- Positive news flow: Amid a raft of recent positive news flow, CyanConnode released solid FY’21 results, demonstrating no discernible impact from COVID-19. No government support was received, and net growth was seen in headcount. In our view, this all reflects strong end-market demand drivers.

- Strong growth in module shipments: 481,000 modules were shipped during the year relating to current contracts, including for the order for 350,000 modules announced in September 2020. Contracts for over 280,000 modules have been signed since the year-end. Revenue recognition across these contracts will vary.

- FY’21 represented strongest financial outturn in company’s history: In our view, together with new contracts, this supports our financial projections for FY’22 and FY’23: we expect revenue to triple over this period, accompanied by a strong move into profitability in FY’23.

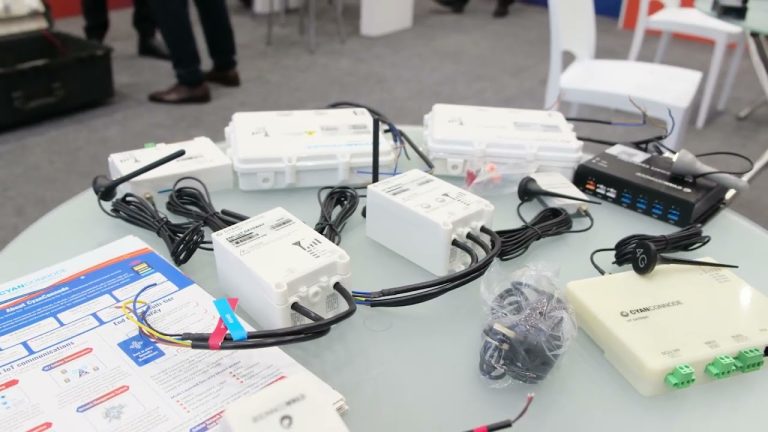

- Substantial market opportunity: The long-term financial trajectory of the business will be a function of the overall market opportunity, which is substantial. In this note, we revisit some of the components of this (IoT, Smart Cities) and the expanded geographical opportunity, including Africa.

- Investment summary: Our updated revenue estimate for FY’22 (to end-March) of £9.3m is based largely on existing contracts, including these latest major wins. CyanConnode remains in discussions for new contracts in several existing and new markets, while its supply chain remains uninterrupted, despite wider silicon shortages. Our DCF-implied equity fair value is £90m (£0.41 per share), compared with the current market capitalisation of £28.3m.