Cora Gold Limited (LON:CORA), the West African focused gold company, has announce Updated Reserves and the results of an updated Definitive Feasibility Study for its flagship Sanankoro Gold Project in southern Mali.

Highlights

● Updated Probable Reserve of 531 koz at 1.13 g/t gold (‘Au’) based on a gold price of US$2,200/oz (a 26% increase over the Maiden Probable Reserve of 422 koz at 1.30 g/t Au based on a gold price of US$1,650/oz (see announcement dated 21 November 2022)).

● 2025 DFS economics (post tax, based on a gold price of US$2,750/oz)

○ 65% internal rate of return (‘IRR’)

○ 1.1 year payback period

○ US$479m free cash flow (‘FCF’) over life of mine (‘LOM’)

○ US$67m pa average FCF in first 5 years

○ US$221m NPV8

○ US$948/oz LOM cash cost and US$1,478/oz LOM all-in sustaining costs (‘AISC’)

○ 10.2 years Reserve mine life

○ 47 koz pa average production LOM

○ 64 koz pa average production in first 5 years

○ US$124m pre-production capital cost (including mining pre-production & contingencies)

● Metallurgical test work confirmed an average LOM gold recovery of 90.7% through a conventional 1.5 Mtpa Carbon in Leach (‘CIL’) processing plant.

● Solar hybrid power option incorporated into the plant design, delivering savings in both operating costs at current fuel prices and carbon emissions by reducing consumption of 40 million litres diesel over LOM.

● As part of the 2025 DFS various optimisations have been incorporated taking greater advantage of the oxide nature of the ore at the front end of the process flow sheet.

● Management Plan, including pit optimised Inferred Resources, based on the same parameters as the Reserves, offers the potential for an additional 173 koz gold produced, adding 5 years to the mine life. Further drilling should enable the conversion of these Inferred Resources to Reserves.

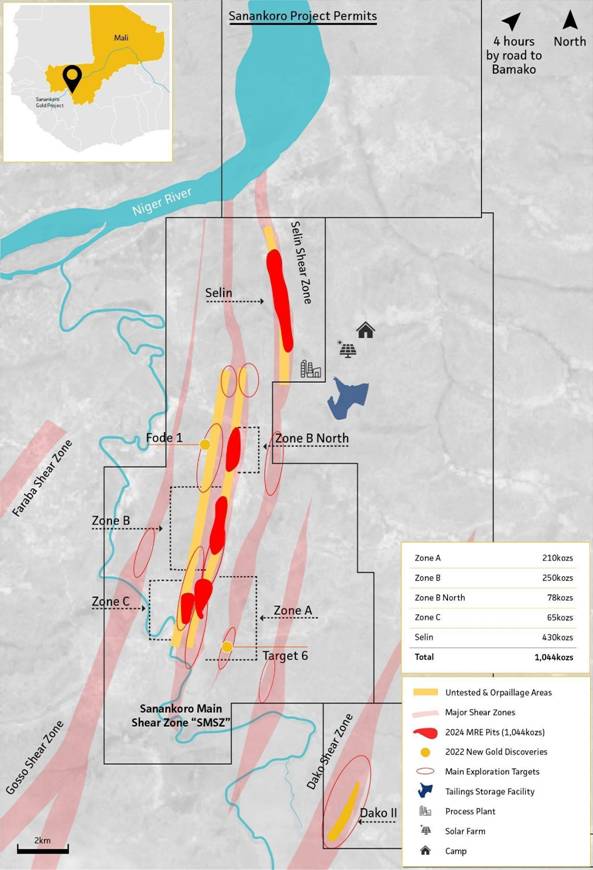

● Sanankoro has excellent exploration and resource growth potential providing the opportunity to significantly add to the current resource base of 1.04 Moz, as optimised pits bottomed out due to lack of deeper drilling and mineralisation is open along strike and at depth. Additionally, there are undrilled artisanal workings, and 19 new exploration targets identified, the majority of which are within 3-4 km from the process plant and the oxide nature of the ore offers further upside.

Bert Monro, Chief Executive Officer of Cora Gold, commented, “Sanankoro is an exceptional project well positioned to become a significant new high margin open pit oxide gold mine. We are delighted to have meaningfully increased the Project’s Reserves, with an initial 10 year mine life, from minimal drilling. The updated Reserves and enhanced DFS significantly improve upon the previous 2022 study, highlighting both the progress we have made in advancing the asset, as well as the opportune time to be developing a gold project of Sanankoro’s calibre.

“In the first 5 years, the Project will average 64 koz of gold production and US$67m of FCF per year, delivering a 1.1 year pay back period and US$479m of FCF over the LOM at a gold price of US$2,750/oz.

“Additionally, significant upside remains as pit optimised Inferred Resources were used to produce a Management Plan, by modelling them using the same parameters as the reserves, indicating an additional 173 koz gold could be added to the life of mine. These ounces will require infill drilling to be classified as Reserves and there remains significant exploration potential outside of current Resources at Sanankoro.

“This study fully incorporates the impact of the new 2023 Mining Code to both the Capex, Opex and local content conformity. Amongst other factors, we made design modifications to the tailings storage facility impacting the Capex. The impact on the AISC in tax and royalty changes was approximately US$290/oz at US$2,750/oz gold price. In light of these factors, it is a strong testament to the robustness of the Project that it is delivering such strong returns.

“Looking ahead, our focus is on concluding the permitting process for the mine so that we can complete financing and begin mine construction. I look forward to updating investors on progress with this in the near future.

“Finally, I’d like to take this opportunity to thank Cora’s technical team and all the DFS consultants for their work on the Project.”

Updated Definitive Feasibility Study – Summary of Results

The key results and financial outcomes of the 2025 DFS are set out in the table below:

| Parameters | Valuesbased on a gold price of US$2,750/oz |

| Construction period 1 (months) | 21 |

| Life of Mine (‘LOM’) (years) | 10.2 |

| LOM waste mined (kt) | 71,520 |

| LOM ore mined (kt) | 14,603 |

| Strip ratio (waste : ore) | 4.90 : 1 |

| LOM grade processed (g/t Au) | 1.13 |

| Average gold recovery | 90.7% |

| LOM production (koz) | 482 |

| Average production (koz pa) | 47 |

| Average production first 5 years (koz pa) | 64 |

| LOM FCF post tax (US$m) | 479 |

| Average FCF post tax (US$ pa) | 47 |

| Average FCF post tax first 5 years (US$m pa) | 67 |

| Mining costs (US$/t ore) | 16.5 |

| Processing & maintenance costs (US$/t ore) | 11.1 |

| General & administration plus other costs to mine gate (US$/t ore) | 3.3 |

| Payback period from start of operations (years) | 1.1 |

| Pre-production capital (US$m)(including US$5m mining pre-production & US$8m contingency) | 124 |

| Sustaining capital (US$m)2 | 57 |

| Average cash cost (US$/oz Au) | 948 |

| Average AISC (US$/oz Au) | 1,478 |

| IRR pre-tax | 74.5% |

| IRR post tax | 64.9% |

| NPV8 pre-tax (US$m) | 302.1 |

| NPV8 post tax (US$m) | 220.8 |

1 includes pre-construction engineering work and commissioning the plant

2 includes closure costs

Gold Price Sensitivity on Key Financial Metrics

| Gold price | US$2,250/oz | US$2,500/oz | US$2,750/oz | US$3,000/oz | US$3,250/oz |

| IRR post tax | 40.9% | 53.5% | 64.9% | 75.9% | 87.5% |

| LOM FCF post tax (US$m) | 336 | 410 | 479 | 547 | 620 |

| NPV8 post tax (US$m) | 121.4 | 172.8 | 220.8 | 268.3 | 318.9 |

| AISC (US$/oz Au) | 1,393 | 1,429 | 1,478 | 1,530 | 1,568 |

Updated Definitive Feasibility Study – Capital and Operating Costs

A pre-production initial capital cost of US$124m, including US$5m mining pre-production and US$8m contingency.

The pre-production capital cost estimate is based on a contractor mining scenario and therefore excludes capital costs associated with a mining fleet.

| Capital items | US$m |

| Civil works | 6.9 |

| Earth works | 3.8 |

| Machinery & equipment | 47.6 |

| Infrastructure | 1.4 |

| Transport | 7.5 |

| First fills | 0.9 |

| Mine camp | 2.8 |

| Project management | 10.3 |

| Insurance & guarantees | 0.8 |

| Tailings storage facility (‘TSF’; phase 1) | 23.5 |

| Owner’s costs | 5.2 |

| Mining pre-production | 5.2 |

| Contingency | 8.1 |

| Total pre-production capital | 124.0 |

| Sustaining & closure capital | 57.0 |

| Total LOM capital | 181.0 |

A solar hybrid power option has been incorporated into the plant design, delivering savings in both operating costs and carbon emissions. The hybrid power generation solution, combining thermal and solar power with a battery energy storage system, anticipates a substantial reduction in diesel fuel consumption saving approximately 4 million litres annually and 40 million litres over the processing period during the mine-life. Reducing diesel use lowers emissions, improving community health, complying with regulations and is a sign of our responsible governance.

| Operating / unit costs (US$/oz of gold) | Valuesbased on a gold price of US$2,750/oz |

| Mining | 499.8 |

| Processing | 322.9 |

| Maintenance | 14.8 |

| General & administration | 101.0 |

| Total cost to mine gate | 938.5 |

| Transport, insurance & refining | 9.1 |

| Total cash cost (‘C1’) | 947.6 |

| Royalties & statutory | 411.7 |

| All-in sustaining cost (‘AISC’) | 1,478 |

Updated Ore Reserves

The 2025 Ore Reserves for the Selin, Zone A and Zone B deposits have been reported according to the JORC (2012) Code.

The estimation of the Ore Reserves followed a process of pit optimisation, design and scheduling:

● The Mineral Resource models were prepared by ERM Australia Consultants Pty Ltd (‘ERM’; formerly CSA Global).

● The mining models were derived from the Mineral Resource models modified for dilution and mining losses through application of Mineable Shape Optimiser (‘MSO’) to determine appropriate factors.

● Using the mining models, pit optimisations were completed in Studio NPVS software (Datamine).

● Using the selected pit shells as templates, pit designs for the final pits and push backs were developed in Deswik CAD. The pit designs and pushbacks considered practical access and geotechnical parameters.

● Based on these designs, a monthly LOM schedule was completed in Deswik IS (Interactive Scheduler) software.

● The schedule economics was verified through a financial analysis and proved to be economically viable.

The 2025 Ore Reserve is stated in Table 1 and the breakdown of the 2025 Ore Reserve by zones is presented in Table 2. An Ore Reserve comparison between 2022 and 2025 by classification and zone is shown in Table 3.

The independent Competent Person for Mineral Reserve estimates is Frikkie Fourie (BEng, Pr. Eng, MSAIMM) of Moletech SA (Pty) Ltd (‘Moletech’).

Table 1: Sanankoro Ore Reserve

| Classification | Oxidation Zone | Tonnage (Mt) | Grade (g/t Au) | Contained metal (koz Au) |

| Proved | Oxide | – | – | – |

| Transitional | – | – | – | |

| Fresh | – | – | – | |

| All Zones | – | – | – | |

| Probable | Oxide | 13.7 | 1.08 | 476 |

| Transitional | 0.9 | 1.86 | 55 | |

| Fresh | – | – | – | |

| All Zones | 14.6 | 1.13 | 531 | |

| Total | 14.6 | 1.13 | 531 |

Notes:

● Figures have been rounded to the appropriate level of precision for the reporting of Ore Reserves.

● Due to rounding, some columns or rows may not compute exactly as shown.

● Ore Reserves are stated as in situ dry tonnes; figures are reported in metric tonnes.

● The Ore Reserve is classified in accordance with the guidelines of the Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012 Edition). Probable Ore Reserves converted from Indicated Mineral Resources.

● The Ore Reserve is reported at a gold price of US$2,200 per troy ounce.

● All Ore Reserves are reported above 0.3 g/t Au cut-off grades and constrained within detailed mine designs derived from mining (including dilution and mining recovery), haulage and processing costs and metallurgical recovery and geotechnical parameters as defined in the study.

● Modifying factors applied:

o Mining recovery and dilution:

▪ Selin: Mining recovery 97.7%, Dilution 6.8%

▪ Zone A: Mining recovery 97.7%, Dilution 6.6%

▪ Zone B: Mining recovery 99.5%, Dilution 8.0%

▪ Zone B North: Mining recovery 97.6%, Dilution 10.1%

o Processing recovery:

▪ Selin: Oxides 93.6%, Transitional 65.6%

▪ Zone A: Oxides 93.6%, Transitional 65.6%

▪ Zone B: Oxides 93.6%, Transitional 65.6%

▪ Zone B North: Oxides 93.6%, Transitional 65.6%

● There are no known legal, political, environmental, or other risks that could materially affect the potential Ore Reserves.

Table 2: Sanankoro Ore Reserve by Zone

| Zone | Classification | Tonnage (Mt) | Grade (g/t Au) | Contained metal (koz Au) |

| A | Proved | – | – | – |

| Probable | 3.7 | 1.17 | 140 | |

| Total | 3.7 | 1.17 | 140 | |

| B | Proved | – | – | – |

| Probable | 3.1 | 1.10 | 111 | |

| Total | 3.1 | 1.10 | 111 | |

| B North | Proved | – | – | – |

| Probable | 1.6 | 0.85 | 43 | |

| Total | 1.6 | 0.85 | 43 | |

| C | Proved | – | – | – |

| Probable | – | – | – | |

| Total | – | – | – | |

| Selin | Proved | – | – | – |

| Probable | 6.2 | 1.19 | 237 | |

| Total | 6.2 | 1.19 | 237 | |

| Total | Proved | – | – | – |

| Probable | 14.6 | 1.13 | 531 | |

| Total | 14.6 | 1.13 | 531 |

Notes:

● Figures have been rounded to the appropriate level of precision for the reporting of Ore Reserves.

● Due to rounding, some columns or rows may not compute exactly as shown.

● Ore Reserves are stated as in situ dry tonnes; figures are reported in metric tonnes.

● The Ore Reserve is classified in accordance with the guidelines of the Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC 2012 Edition). Probable Ore Reserves converted from Indicated Mineral Resources.

● The Ore Reserve is reported at a gold price of US$2,200 per troy ounce.

● All Ore Reserves are reported above 0.3 g/t Au cut-off grades and constrained within detailed mine designs derived from mining (including dilution and mining recovery), haulage and processing costs and metallurgical recovery and geotechnical parameters as defined in the study.

● Modifying factors applied:

o Mining recovery and dilution:

▪ Selin: Mining recovery 97.7%, Dilution 6.8%

▪ Zone A: Mining recovery 97.7%, Dilution 6.6%

▪ Zone B: Mining recovery 99.5%, Dilution 8.0%

▪ Zone B North: Mining recovery 97.6%, Dilution 10.1%

o Processing recovery:

▪ Selin: Oxides 93.6%, Transitional 65.6%

▪ Zone A: Oxides 93.6%, Transitional 65.6%

▪ Zone B: Oxides 93.6%, Transitional 65.6%

▪ Zone B North: Oxides 93.6%, Transitional 65.6%

● There are no known legal, political, environmental, or other risks that could materially affect the potential Ore Reserves.

Table 3: Comparison 2022 Ore Reserve vs 2025 Ore Reserve by Zone

| Classification | Zone | 2022 Ore Reserve | 2025 Ore Reserve | Difference | % difference | ||||||||

| Tonnage (Mt) | Au | Au | Tonnage (Mt) | Au | Au | Tonnage (Mt) | Au | Au | Tonnage (Mt) | Au | Au | ||

| (g/t) | (koz) | (g/t) | (koz) | (g/t) | (koz) | (g/t) | (koz) | ||||||

| Probable | A | 2.8 | 1.32 | 117 | 3.7 | 1.17 | 140 | 1.0 | -0.15 | 23 | 35% | -11% | 20% |

| B | 2.0 | 1.24 | 81 | 3.1 | 1.10 | 111 | 1.1 | -0.14 | 30 | 55% | -12% | 37% | |

| B Nth | 1.0 | 0.91 | 30 | 1.6 | 0.85 | 43 | 0.5 | -0.06 | 13 | 54% | -7% | 43% | |

| Selin | 4.3 | 1.41 | 194 | 6.2 | 1.19 | 237 | 1.9 | -0.21 | 43 | 44% | -15% | 22% | |

| Total | 10.1 | 1.30 | 422 | 14.6 | 1.13 | 531 | 4.5 | -0.17 | 109 | 45% | -13% | 26% | |

Notes:

● The 2022 Ore Reserves are at a 0.35 g/t Au cut-off and pits designed based on US$1,650/oz gold price. The 2025 Ore Reserves are at a 0.3 g/t Au cut-off and pits designed based on US$2,200/oz gold price.

Mining

The mining of Selin, Zone A and Zone B is well-suited to typical open pit methods using a backhoe configured excavator and truck fleet which will be operated by a mining contractor. Considering the highly-weathered nature of the orebody, both the oxide and transitional material are viewed as ‘free-dig’ with no need for drill and blast activities. Open pit operations will be undertaken using 5 metre benches which will be stacked to 10 metres at final limits. It is the intention that topsoil (initial 30cm) be stripped initially over the area of both the open pit and waste rock dumps (‘WRDs’) and stockpiled in a suitable allocated area proximal to each of the pits. Clearing and grubbing costs have been provisioned and this material will be used in remediation work as part of the mine closure.

Waste material will be dumped onto designated waste dumps. Dumping will take place in 10 metre layers to a general maximum of 50 metres in height. Run of mine (‘ROM’) material destined for the processing plant will be sent straight to the stockpile area. Stockpiling and blending may be necessary to optimise the head grade with feed constraints on transitional material. Sufficient space will be provided for several separate stockpiles. All process feed will be re-handled by a wheel loader from the stockpile straight into the crusher.

Plant Feed by Ore Type (kt) and Grade (g/t Au)

Au Recovered (Oz) and Recovery (%)

Processing

The proposed process plant design was initially based on a well-known and established gravity/CIL technology, which consisted of conventional crushing, milling, and gravity recovery of free gold, followed by leaching/adsorption of gravity tailings, elution, gold smelting, and tailings disposal with a cyanide detoxification plant.

The presence of fines (near product size material) in the ore body led to scrubbing testwork being conducted, which resulted in a modified front end for the process plant by replacing the jaw crusher with a mineral sizer; scrubber; cone crusher to treat scrubber oversize and a downsized ball mill. Transition ore, scheduled to be mined during year three of production, will be treated by initial mobile hard rock crushing facility for the limited transition ore mining period.

The process plant will cater for reagent mixing, storage and distribution, water and air services. A water treatment plant is included to manage any potential water discharge from the TSF and mining pits.

The plant will treat 1.5 Mtpa of oxide ore or 1.1 Mtpa of transition ore if treated independently, although oxide and transition ore blending is more likely during the period of processing transition ore, resulting in 1.2 Mtpa throughput at that time.

The process plant design incorporates the following unit process operations:

● Primary particle reduction by mineral sizer and jaw crusher – to crush the oxide and transition ores respectively.

● Milling – product from mineral sizer (oxide ore) will be fed into a rotary scrubber and screened by double deck vibrating screen. Oversized material will be conveyed to a cone crusher for further particle reduction and milled in a single-stage ball mill in closed circuit with hydro-cyclones to produce a P80 of 150 µm reporting to the CIL circuit. For the transition ore, the mobile crushing facility will reduce the ore to size adequate to feed the mill which is also in closed circuit with hydro-cyclones, to produce P80 grind size of 75 µm before reporting to the CIL circuit. Scrubber screen undersize product (<150 µm) will bypass the mill.

● Gravity Concentration – recovery of coarse gold from the milling circuit recirculating load and treatment of gravity concentrates by intensive cyanidation and electrowinning to recover gold to doré.

● Leach/CIL circuit – for gold dissolution and adsorption onto carbon incorporating six CIL tanks.

● Loaded Carbon Desorption – elution circuit, electrowinning, and gold smelting to recover gold from the loaded carbon to produce doré.

● Detoxification – an INCO air / SO2 cyanide detoxification facility for the CIL tails slurry, which will be used only when required as test work has shown that the weak acid dissociable cyanide levels in the leached tails are less than 50 ppm.

● Tailings Storage Facility (‘TSF’) – tailings pumping to the TSF.

Site Layout

Process Flow Sheet

|

Management Plan

The Company’s independent mining engineer designed a Management Plan based on pit optimised Resources. These Resources were run through mine scheduling software using the same parameters as the Reserves to develop a theoretical mine plan. The Management Plan shows the potential for an additional 173 koz of gold to be mined from current Inferred Resources. The Company will in the future target these ounces with more drilling to convert to Reserves.

Permitting

In October 2022 Cora announced the award of an Environmental Permit for the Sanankoro Gold Project (see announcement dated 18 October 2022).

On 28 November 2023 the Mali government announced the suspension of issuing permits in the mining sector. On 15 March 2025 this moratorium was partially lifted by the government such that, in accordance with the provisions of the 2023 Mining Code and its implementing texts, the mining administration can receive for processing:

● applications to renew exploration permits and mining permits;

● applications for transition from the exploration phase to the mining phase; and

● applications for the transfer of mining permits.

This partial lifting of the moratorium does not apply to:

● applications for the issuance of new permits; or

● applications for the transfer of exploration permits.

During the period of the moratorium the processes for submission of applications both for new permits and for interim renewals, and for the issuance of new permits and interim renewals have been affected. With regards to Cora’s five contiguous permits in the Sanankoro Project area, the moratorium impacted the interim renewals of the Bokoro Est, Dako II and Sanankoro II exploration permits, and applications for new permits in relation to the Bokoro II and Kodiou exploration permits, the respective expiry dates of which were in the moratorium period. Cora is actively engaging with the mining administration in Mali regarding these matters and being issued a mining permit for Sanankoro. The area of the mining permit will include parts of each of the Bokoro II, Kodiou and Sanankoro II exploration permits.

In accordance with the 2023 Mining Code:

● the granting of a mining permit entitles the State to hold a 10% free carried shareholding in the capital of the operating company;

● the State also has the option of increasing its participation in the operating company by purchasing an additional shareholding of up to 20% – this option can be exercised by the State within 12 months following the date of issue of the mining permit; and

● the operating company is required to transfer 5% of its shares to Malian national investors through the State-owned mining company, with Malian national investors purchasing such shares on the same basis as the State’s purchase of its additional shareholding of up to 20%.

In summary, therefore, the total shareholdings of the State and Malian national investors in operating companies may be up to 35%.