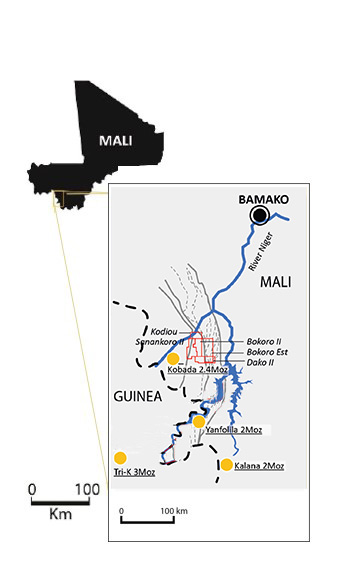

Cora Gold Ltd (LON:CORA), together with its subsidiaries, explores for and develops mineral projects in West Africa. The company primarily explores for gold deposits. Its flagship project is the Sanankoro Gold project located in the Yanfolila Gold Belt, Southern Mali. The company also focuses in the Kenieba project located at the Kenieba Window, West Mali.

Cora Gold’s highly experienced management team has a proven track record in making multi-million-ounce gold discoveries across Africa which have been developed into operating mines.

| Sanankoro Gold Project | |

|---|---|

| Location | Yanfolila Gold Belt, south Mali |

| Project Area | Five contiguous permits (Bokoro II, Bokoro Est, Dako II, Kodiou & Sanankoro II) covering approximately 342 sq km |

| Gold Mineralisation | Oxides up to 207m depth & high-grade sulphides identified at depth |

| DFS & Optimised Project Economics (2022) |

(based on a gold price of US$1,750/oz; announcement 21 November 2022) Updated DFS due 2025 |

| Maiden Probable Reserve (2022) | 10.1 Mt at 1.30 g/t Au for 422 koz (based on a gold price of US$1,650/oz; announcement 21 November 2022) |

| Mineral Resource Estimate (2024) | 31.4 Mt at 1.04 g/t Au for 1,044 koz, comprising:

(based on a gold price of US$2,400/oz; cut-off grade 0.3 g/t Au; announcement 15 January 2025) |

| Additional Exploration Target (2022) | 26.0-35.2 Mt at 0.58-1.21 g/t Au for 490-1,370 koz (announcement 07 November 2022) |

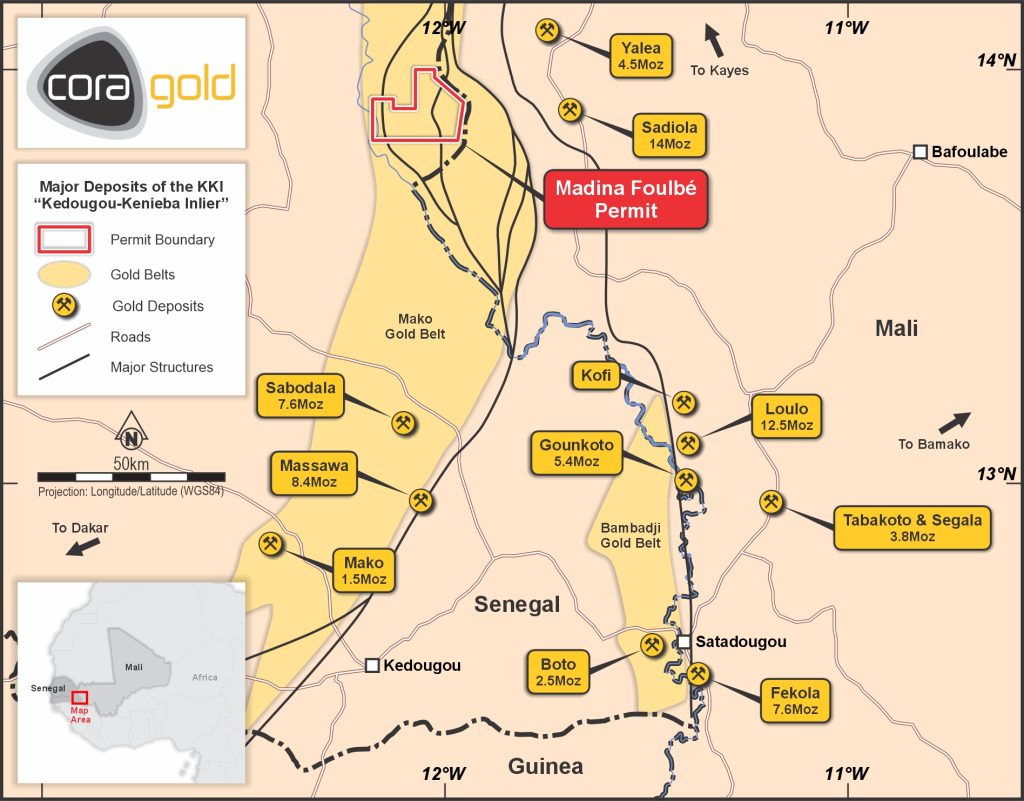

| Kenieba Project Area | |

|---|---|

| Location | Kenieba Window, west Mali / east Senegal |

| Project Area | One permit, being Madina Foulbé in east Senegal – awarded on 15 January 2018, covering 260 sq km; area subsequently reducing by 25% on each of two interim renewals in accordance with the regulations |

| Exploration Results (from drilling in 2020 & 2024) | Identified multiple broad zones with elevated gold and some economic intercepts, including:

|