Copper prices are surging, propelled by tightening global supply and escalating U.S. demand, creating a pivotal moment for investors. This rally is not merely a market fluctuation; it’s a reflection of deeper structural shifts in global trade and industrial demand.

The copper market is experiencing a significant upswing, driven by a confluence of supply constraints and robust demand, particularly from the United States. This surge is reshaping global trade patterns and presenting unique opportunities for investors attuned to commodity markets.

In recent months, copper prices have climbed sharply, with U.S. futures reaching \$5.02 per pound, marking a 26% increase year-to-date. This ascent surpasses global benchmarks, highlighting the U.S. market’s intensified demand. Factors such as the anticipated implementation of a 25% import tariff and the invocation of the Defense Production Act to bolster domestic copper production have further fueled this demand.

The impending tariffs have prompted a surge in copper imports into the U.S., as manufacturers and traders seek to secure supplies ahead of potential cost increases. This influx is causing a notable shift in global copper flows, with inventories being redirected from other regions to satisfy U.S. requirements. Consequently, stockpiles in key markets like China and Europe are diminishing, exacerbating the global supply tightness.

Analysts project that this trend will lead to a significant increase in U.S. copper inventories, potentially reaching 300,000 to 400,000 tons by the end of the third quarter, up from the current 95,000 tons. This accumulation could account for up to 60% of global reported stocks, underscoring the U.S.’s dominant position in the copper market.

The supply constraints are further intensified by challenges in major producing countries. In China, smelting costs have plummeted, occasionally turning negative, indicating difficulties in securing raw copper for processing. Such conditions suggest that Chinese smelters are operating at a loss to maintain production, reflecting the severity of the supply shortage.

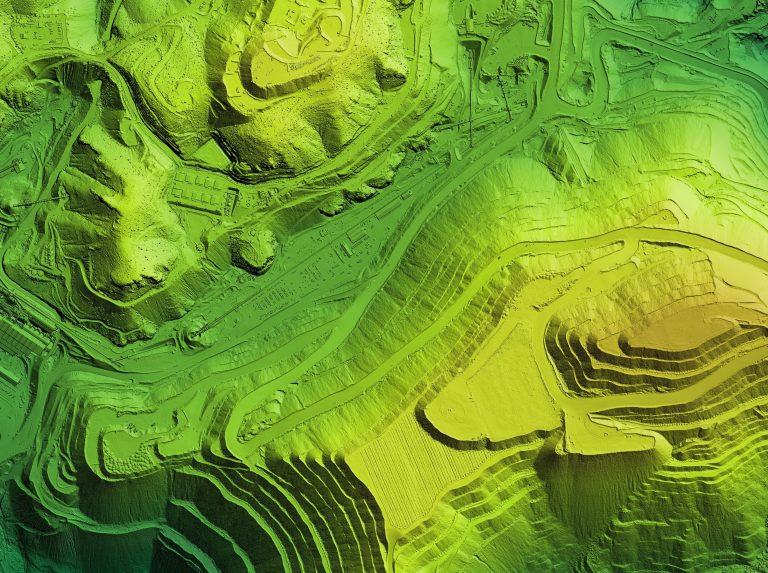

ARC Minerals Ltd (LON:ARCM) is a dynamic exploration and prospect generation company, forging partnerships with major mining companies, in its quest to discover and develop Tier 1 copper deposits.