Copper prices have recently climbed, driven by a significant drop in inventories at the London Metal Exchange (LME). This supply constraint, coupled with escalating global demand, particularly from the clean energy sector, is reshaping the copper market landscape.

On Wednesday, copper three-month futures on the LME rose by 0.5% to $9,639 per tonne, marking a two-week high of $9,655. This uptick is attributed to a 43% decline in LME copper inventories since mid-February, reaching a yearly low of 154,300 tonnes. The widening gap between spot prices and three-month futures, which expanded from $3 to $40 per tonne within a week, signals tightening supply conditions.

The market is also influenced by geopolitical factors. Earlier this year, U.S. President Donald Trump hinted at imposing a 25% tariff on copper imports, prompting accelerated shipments to the U.S. and pushing domestic prices to a record $11,633 per tonne in March, significantly higher than London prices. While trade tensions have somewhat eased, the potential for future tariffs continues to create market uncertainty.

Looking ahead, the International Energy Agency (IEA) projects that global copper demand will outstrip supply by 30% by 2035, driven by the transition to clean energy technologies. This anticipated shortfall underscores the critical need for investment in copper mining and recycling to meet future demand.

In summary, the copper market is experiencing a confluence of supply constraints and rising demand, influenced by both inventory levels and geopolitical developments. Investors should closely monitor these dynamics, as they have significant implications for commodity markets and related sectors.

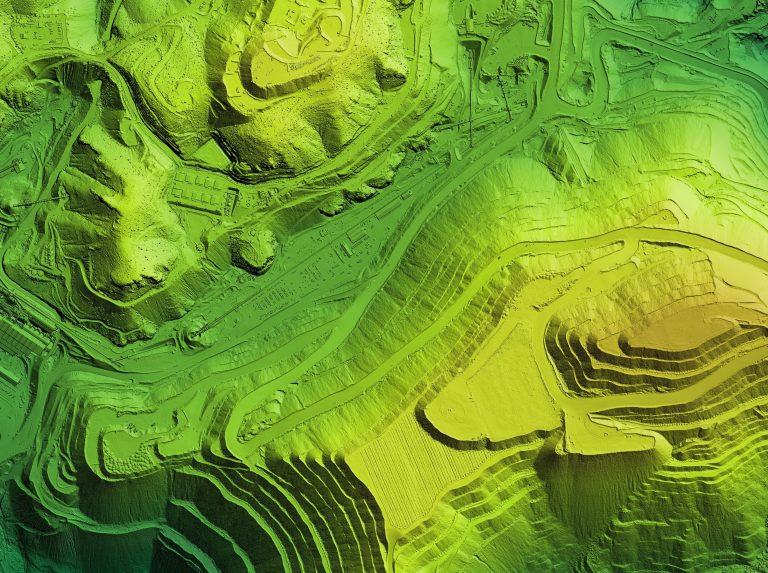

ARC Minerals Ltd (LON:ARCM) is a dynamic exploration and prospect generation company, forging partnerships with major mining companies, in its quest to discover and develop Tier 1 copper deposits.