Arc Minerals has secured another key asset in its Zambian portfolio, acquiring the Chingola copper project through its wholly-owned subsidiary, Foreland Minerals. This move is a calculated addition to Arc’s expanding footprint in the Copperbelt, one of the world’s most prolific copper-producing regions. The 311 km² Chingola licence sits adjacent to high-performing mines like Vedanta’s Nchanga and Moxico Resources’ Mimbula operations, giving Arc a strategic advantage in terms of infrastructure and proven mineralisation.

The acquisition terms are designed with flexibility, allowing Arc to scale its commitment alongside exploration progress. An initial $50,000 payment secures the deal, followed by staged payments triggered by milestones including drilling commencement, confirmed mineral resources, and the completion of a definitive feasibility study. A capped 2% net smelter royalty ensures Brxton Construction retains upside without burdening Arc’s financial outlook.

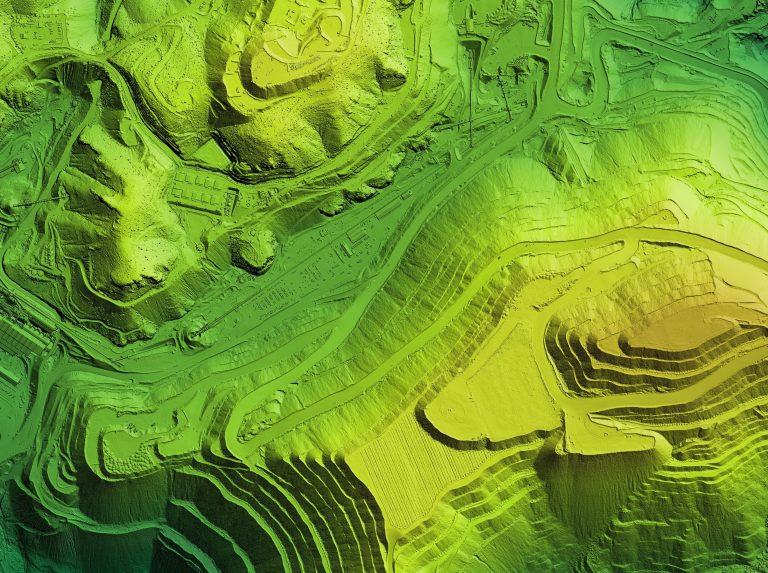

This project is more than just acreage; it represents Arc’s commitment to acquiring high-grade, high-potential assets. Chingola, located in the historically richer north-eastern Copperbelt, offers strong geological fundamentals. A fully funded soil sampling programme is already on the cards, setting the stage for a swift start to exploration.

But Arc’s ambitions are far broader than Chingola. Under Chairman Nick von Schirnding—whose experience includes senior roles at Anglo American and De Beers—the company has built a commanding asset base in both Zambia and Botswana. Most notably, Arc’s joint venture with Anglo American marks a turning point in its journey from small-cap explorer to serious copper contender.

Valued at up to $14.5 million in staged payments to Arc, with an additional $74 million committed by Anglo for project development, the JV spans approximately 767 km² in Zambia’s North Western Province. This is no speculative play—the area is home to flagship operations like First Quantum’s Sentinel and Kansanshi mines and Barrick’s Lumwana. Anglo’s return to Zambia after two decades, via this JV, underscores its renewed belief in the region’s long-term copper value.

Recent drilling in the Mwinilunga district has added substance to Arc’s story. Results such as 40.6 metres at 0.61% copper, including higher-grade sections of over 1.7%, confirm the presence of both oxide and deeper sulphide mineralisation. These grades, intersected from shallow depths, suggest strong near-term development potential. Analysts at Zeus Capital are already taking note, with positive commentary on the scope and quality of Arc’s early-stage results.

Beyond Zambia, Arc is leveraging its regional knowledge in Botswana’s Kalahari Copper Belt. Its Virgo project, just 10 km from the newly operational Khoemacau mine, positions Arc near one of southern Africa’s hottest copper zones. Holding a 75% stake in Alvis-Crest, Arc controls more than 210 km² of licences within the Central Structural Corridor, placing it close to significant discoveries like the Zone 5 and Banana Zone deposits.