National Grid plc (LON:NG) has announced its Half Year results for the period ended 30 September 2025.

Building our energy future

John Pettigrew, Chief Executive said: “Our financial performance reflects another period of strong operational delivery in line with our five-year financial frame. We continue to deliver for our customers, investing a record £5 billion this half, and we are on track to invest over £11 billion this year. We continue to innovate, secure our supply chain and expand our talent pipeline to efficiently deliver our plans on both sides of the Atlantic. This investment in our networks is critical to ensure continued resilience, enable economic growth, deliver cleaner energy, and meet growing power demand. It’s been a privilege to lead National Grid through a significant decade of growth and I’m confident that under Zoë Yujnovich’s leadership, National Grid will continue to deliver for our customers and stakeholders.”

| Financial summary | ||||||||||

| Six months ended 30 September | Statutory results | Underlying1 | Underlying at constant currency1,2 | |||||||

| (unaudited) | 2025 | 2024 | % change | 2025 | 2024 | % change | 2024 | % change | ||

| Operating profit (£m) | 1,526 | 1,309 | 17% | 2,292 | 2,046 | 12% | 2,026 | 13% | ||

| Profit before tax (£m) | 826 | 684 | 21% | 1,653 | 1,436 | 15% | 1,433 | 15% | ||

| Earnings per share (p) | 12.6 | 12.6 | -% | 29.8 | 28.1 | 6% | 28.0 | 6% | ||

| Dividend per share (p) | 16.35 | 15.84 | 3% | |||||||

| Capital investment (£m) | 5,052 | 4,603 | 10% | |||||||

1. ‘Underlying’ is a non-GAAP alternative performance measure (APM) used by management to monitor performance across the Group. This measure along with other APMs used in this report are explained in more detail on pages 47 to 51. These measures are not substitutes for IFRS measures, however management believes such additional information is useful in assessing the performance of the business on a comparable basis.

2. Constant currency calculated using current year average exchange rate of $1.353 (2024: actual average exchange rate was $1.296).

Continued delivery against our strategic objectives

Financial performance

■ Underlying EPS of 29.8p, up 6% with FY2026 guidance modestly higher reflecting stronger underlying performance partially offset by exchange rate headwinds. Statutory EPS constant at 12.6p.

■ Higher underlying operating profit reflects increased investment across our regulated businesses.

■ Interim dividend of 16.35p, 35% of prior year full dividend.

Strategic initiatives

■ Supporting the UK Government in the development of AI Growth Zones, and readiness to connect 19 GW of additional demand in RIIO-T3.

■ Supply chain and delivery mechanisms now secured for more than three-quarters of our £60 billion five-year investment plan. In the first half of this year we have:

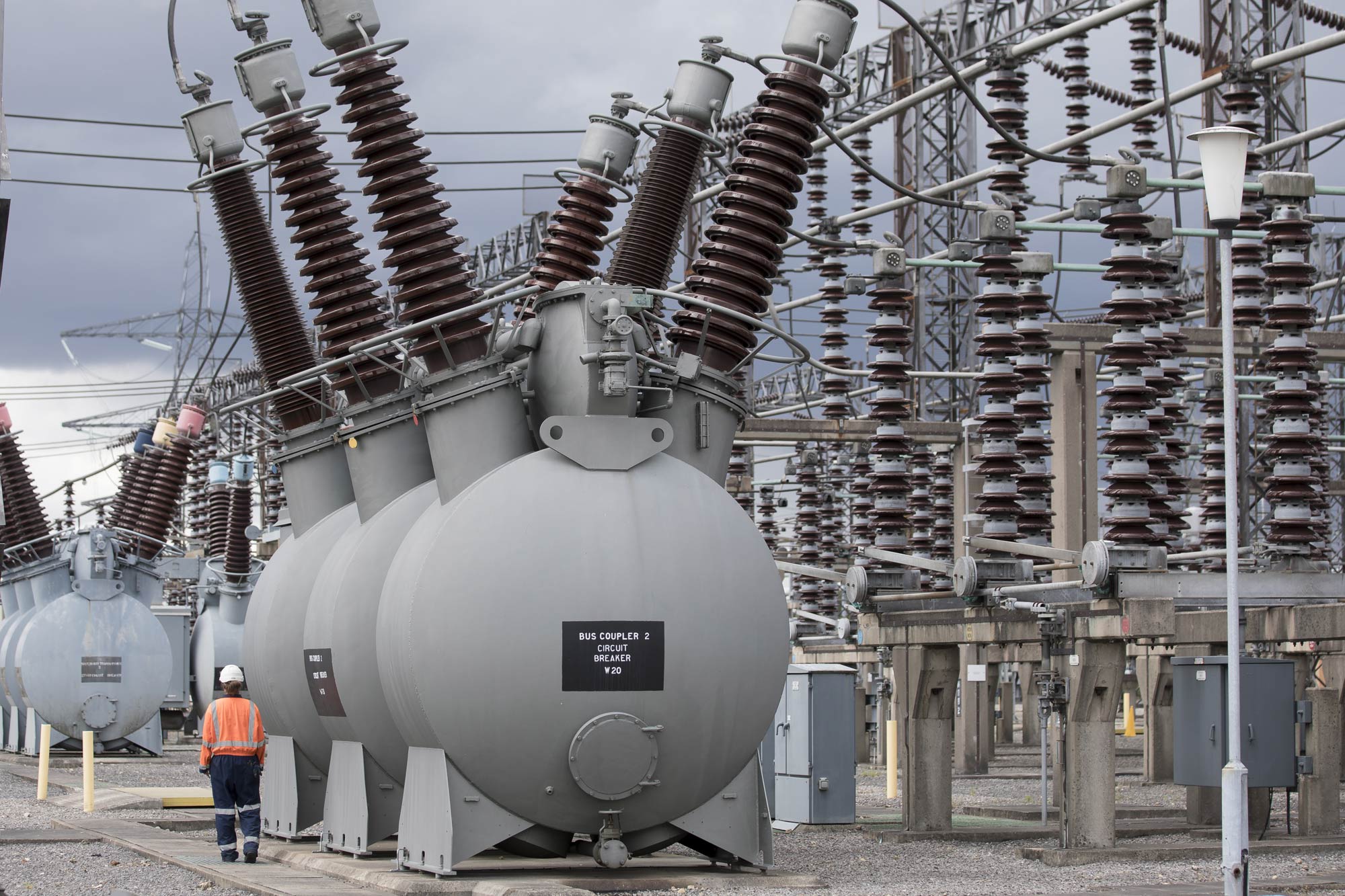

■ agreed £8 billion Electricity Transmission Partnership for substation construction;

■ established a £12 billion HVDC framework for civil works in the UK; and

■ agreed the partners to support over $3 billion of capital work in New England across the next five years.

■ Delivered our three-year target of £100 million cumulative synergies from the acquisition of UK Electricity Distribution, six months ahead of schedule.

■ Continued to streamline the portfolio with National Grid Renewables divested and Grain LNG sale agreed.

Key projects

■ Strong progress on construction of all six Wave 1 ASTI* projects in the UK.

■ Planning applications for Norwich to Tilbury and Sea Link Wave 2 ASTI projects accepted by UK Planning Inspectorate.

■ Smart Path Connect project to upgrade more than 100 miles of transmission lines in upstate New York ready to energise in December 2025.

■ Replaced a further 208 miles of leak-prone pipe across our gas networks in the US.

Regulatory updates

■ Responded to Ofgem’s Draft Determination for the RIIO-T3 price control where our investments are expected to avoid £12 billion in constraint costs, equating to £40 per year for consumers.

■ NIMO three-year electricity and gas rate case received regulatory approval.

■ Received approval for around $600 million investment under the Electric Sector Modernization Plan (ESMP) in Massachusetts.

■ Around 75% of the US investment in our five-year frame approved by our regulators.

*See glossary on page 20.

Financial outlook and guidance

■ Guidance is based on our continuing businesses, as defined by IFRS and includes the contribution of the ESO, National Grid Renewables and Grain LNG up until disposal. It excludes the minority stake in National Gas Transmission, which was classified as a discontinued operation until disposal.

■ Financial outlook over the five-year period from 2024/25 to 2028/29:

■ total cumulative capital investment of around £60 billion;

■ Group asset growth CAGR1 of around 10% backed by strong balance sheet;

■ driving underlying EPS CAGR2 of 6-8% from the 2024/25 EPS baseline of 73.3p;

■ credit metrics consistent with current Group rating; and

■ regulatory gearing expected to increase towards the mid-60% range by March 2029 and then trend towards the high 60% range by the end of RIIO-T3.

■ For 2025/26, we expect strong operational performance across the Group with underlying EPS expected to be in line with the 6-8% CAGR range from the 2024/25 baseline.

1. Group asset compound annual growth rate from a FY24 baseline. Forward years based on assumed USD FX rate of 1.25; and long run UK CPIH and US CPI. Assumes sale of ESO, Grain LNG, and National Grid Renewables before 2029. Assumes 20% stake in National Gas Transmission treated as a discontinued operation and therefore does not contribute to Group asset growth.

2. Underlying EPS compound annual growth rate from FY25 baseline. Forward years based on assumed USD FX rate of 1.25; long run UK CPIH, US CPI and interest rate assumptions and scrip uptake of 25%. Assumed sale of Grain LNG and National Grid Renewables before 2029. Assumed 20% stake in National Gas Transmission treated as a discontinued operation and therefore did not contribute to underlying EPS.

Chief Executive Officer succession

On 1 September 2025, Zoë Yujnovich joined as Chief Executive Designate, and will become Chief Executive Officer with effect from 17 November 2025, succeeding John Pettigrew, who after nearly a decade in role, will retire from National Grid on 16 November 2025.

| Results presentation and webcast | ||

| An audio webcast and live Q&A with management will be held at 09:15 (GMT) today. Please use this link to join via a laptop, smartphone or tablet: https://www.nationalgrid.com/investors/events/results-centre A replay of the webcast will be available soon after the event at the same link. | ||

| UK (and International) | +44 (0) 330 551 0200 | |

| UK (Toll Free) | 0808 109 0700 | |

| US (Local) | +1 786 697 3501 | |

| Password | Quote “National Grid HY” when prompted by the operator | |