The stock price for HSBC Holdings with company EPIC: LON:HSBA has stepped up 3.74% or 16.35 points during today’s session so far. Investors have stayed positive throughout the trading session. The periods high has already touched 456.8 dipping to 443.3. The total volume traded so far comes to 9,361,116 while the average shares exchanged is 25,852,745. The 52 week high for the share price is 523 amounting to 85.4 points difference from the previous days close and putting the 52 week low at 281.5 a difference of some 156.1 points. HSBC Holdings has a 20 SMA of 424.98 and now its 50 day moving average now of 412.11. Market capitalisation is now £92,464.03m at the time of this report. The currency for this stock is GBX. Market cap is measured in GBP. This article was written with the last trade for HSBC Holdings being recorded at Monday, March 8, 2021 at 12:32:01 PM GMT with the stock price trading at 453.95 GBX.

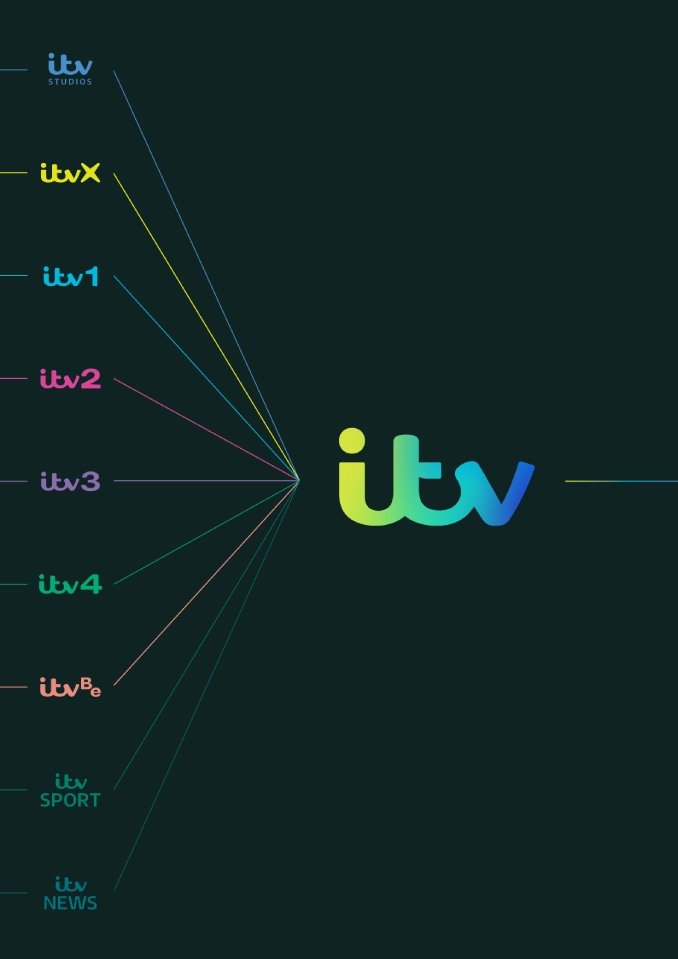

Shares in ITV company symbol: LON:ITV has increased 3% or 3.5 points in today’s trading session so far. Investors seem confident while the stock has been in play. The period high was 121.05 while the low for the session was 117.6. Volume total for shares traded at this point reached 4,032,298 while the daily average number of shares exchanged is 11,743,743. A 52 week high for the stock is 121.05 amounting to 4.4 points different to the previous business close and a 52 week low sitting at 50.06 a difference of some 66.59 points. ITV now has a 20 SMA of 113.87 and the 50 day simple moving average now at 111.49. This puts the market cap at £4,836.53m at the time of this report. Share price is traded in GBX. Mcap is measured in GBP. This article was written with the last trade for ITV being recorded at Monday, March 8, 2021 at 12:32:03 PM GMT with the stock price trading at 120.15 GBX.

Shares of KRM22 ticker code: LON:KRM has stepped up 4.76% or 2 points throughout the session so far. Buyers have so far held a positive outlook throughout the trading session. The periods high has already touched 44 meanwhile the session low reached 44. The total volume of shares exchanged through this period comes to 2,000 with the daily average number around 2,495. The stock 52 week high is 51.5 which is 9.5 points difference from the previous days close and the 52 week low at 20 making a difference of 22 points. KRM22 has a 20 day moving average of 41.2 and now a 50 day moving average now at 41.66. The current market capitalisation is £11.76m at the time of this report. The currency for this stock is Great British pence.Market cap is measured in GBP. This article was written with the last trade for KRM22 being recorded at Monday, March 8, 2021 at 10:47:32 AM GMT with the stock price trading at 44 GBX.

The trading price for Lloyds Banking Group company symbol: LON:LLOY has moved up 3.82% or 1.53 points throughout the session so far. Traders have remained optimistic throughout the trading session. The high for the period has reached 41.77 meanwhile the session low reached 40.29. The total volume traded so far comes to 133,535,693 with the daily average number around 248,154,390. The 52 week high is 59.94 amounting to 19.86 points difference from the previous close and the 52 week low at 23.59 which is a difference of 16.49 points. Lloyds Banking Group now has a 20 simple moving average of 39.29 and now a 50 day moving average now of 37.5. The market capitalisation is now £29,477.30m at the time of this report. Share price is traded in GBX. Mcap is measured in GBP. This article was written with the last trade for Lloyds Banking Group being recorded at Monday, March 8, 2021 at 12:31:59 PM GMT with the stock price trading at 41.61 GBX.