For individual investors seeking exposure to the healthcare sector, particularly in drug manufacturing, GSK plc (NYSE: GSK) presents a compelling profile. With a rich history dating back to 1715, this UK-based pharmaceutical giant has been at the forefront of developing vaccines and specialty medicines. However, its current financial metrics and market standings offer a complex landscape for potential investors to navigate.

**Market Overview and Stock Performance**

GSK’s current market capitalization stands at a robust $81.55 billion, reflecting its substantial footprint in the healthcare sector. Currently priced at $40.50, the stock has experienced a modest price change of 0.89 (0.02%) and trades within a 52-week range of $32.08 to $44.10. This range indicates a relatively stable performance, though it hovers near its upper limits.

**Valuation and Financial Health**

A distinctive feature of GSK’s financial profile is its forward P/E ratio of 8.84, which suggests that the stock is potentially undervalued relative to its earnings forecast. However, the absence of a trailing P/E ratio and other valuation metrics like PEG, Price/Book, and Price/Sales raises questions about its current valuation clarity.

The company has reported a revenue growth of 1.30%, which, while modest, aligns with its strategic focus on steady expansion. Importantly, the return on equity at 28.33% is a testament to GSK’s ability to generate profit from shareholders’ equity, showcasing effective management and operational efficiency. Free cash flow, a critical indicator of financial health, stands at an impressive $5.48 billion, providing the company with the flexibility to invest in growth opportunities and sustain its dividend payouts.

**Dividend Appeal**

For income-focused investors, GSK offers a compelling dividend yield of 4.07% with a payout ratio of 75.07%. This high yield, combined with a sustainable payout ratio, underscores the company’s commitment to returning value to its shareholders, even amidst fluctuating earnings.

**Analyst Ratings and Market Sentiment**

Despite its strengths, GSK faces a cautious market sentiment. Currently, no analysts have issued a “Buy” rating, with 5 “Hold” and 2 “Sell” ratings dominating the narrative. The average target price of $39.03 implies a potential downside of -3.63%, suggesting that the market perceives limited short-term upside.

**Technical Indicators**

Technical analysis provides additional insights for GSK’s stock performance. The stock’s 50-day and 200-day moving averages are $38.50 and $37.16, respectively, indicating a stable upward trend over the medium term. However, a Relative Strength Index (RSI) of 21.52 suggests that the stock is currently oversold, which might present a buying opportunity for contrarian investors looking for entry points in undervalued stocks.

**Strategic Initiatives and Future Outlook**

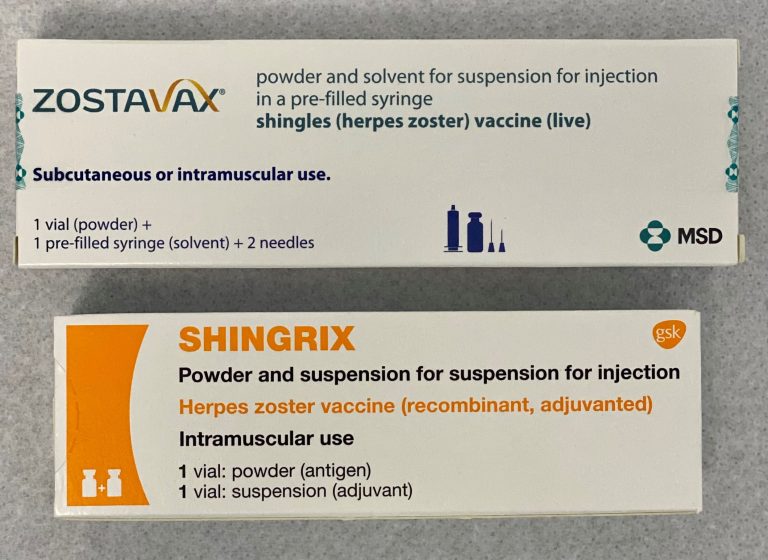

GSK’s strategic initiatives, including its collaboration with CureVac to develop mRNA vaccines, highlight its commitment to innovation and addressing emerging healthcare needs. This partnership positions GSK to capitalize on the growing demand for advanced vaccine solutions, potentially driving future revenue growth.

In the broader context, GSK’s extensive portfolio of specialty medicines and vaccines for various diseases, including respiratory illnesses and cancers, aligns it well with global health priorities. This positions the company to continue its leadership in the healthcare industry, leveraging its research and development capabilities to overcome market challenges.

Investors considering GSK should weigh its strong dividend yield and operational efficiency against the cautious market sentiment and valuation uncertainties. As always, thorough due diligence and an understanding of personal investment goals are critical when navigating investments in complex, multifaceted companies like GSK.