GSK plc (GSK), a titan in the healthcare sector, stands as a prominent player in the drug manufacturing industry with a market capitalization of $88.28 billion. Headquartered in London, this British pharmaceutical giant is renowned for its extensive portfolio in vaccines, specialty medicines, and general medicines, addressing a myriad of diseases worldwide. As investors evaluate GSK’s potential, a detailed look into the stock’s valuation, performance metrics, and analyst sentiment provides critical insights.

As of the latest trading session, GSK’s stock is priced at $43.91, marking a modest price change with no significant percentage variation. The stock’s 52-week range showcases notable volatility, with a low of $32.08 and a high of $45.51, indicating that the current price is near its upper trading band. Despite this, the average analyst target price of $42.59 suggests a potential downside of approximately 3.01%, a signal that investors should approach with caution.

Valuation metrics for GSK reveal a mixed picture. The company’s forward P/E ratio stands at a relatively attractive 9.26, suggesting that the stock might be undervalued compared to future earnings prospects. However, the absence of trailing P/E, PEG, and other key valuation indicators leaves some gaps in the financial narrative, which might concern some investors seeking a comprehensive valuation framework.

GSK’s performance metrics provide a more encouraging view. The company reports a revenue growth rate of 1.30%, which, while modest, is complemented by a robust return on equity (ROE) of 28.33%. This high ROE indicates efficient management performance in generating profits from shareholders’ equity. Furthermore, with an impressive free cash flow of over $5.47 billion, GSK is well-positioned to sustain its operations and continue rewarding its shareholders.

Dividend investors might find GSK particularly appealing due to its generous dividend yield of 3.76%. While the payout ratio of 75.07% indicates a significant portion of earnings is returned to shareholders, it also underscores the company’s commitment to maintaining its dividend policy, which can be appealing in a low-interest-rate environment.

Current analyst sentiment leans towards caution, with only one buy rating against five hold and two sell ratings. This sentiment is further reflected in the stock’s technical indicators, where a Relative Strength Index (RSI) of 32.05 hints at potential overselling, possibly presenting a buying opportunity for those with a contrarian approach. Meanwhile, the MACD and signal line are nearly aligned, suggesting a neutral momentum in the stock’s price movements.

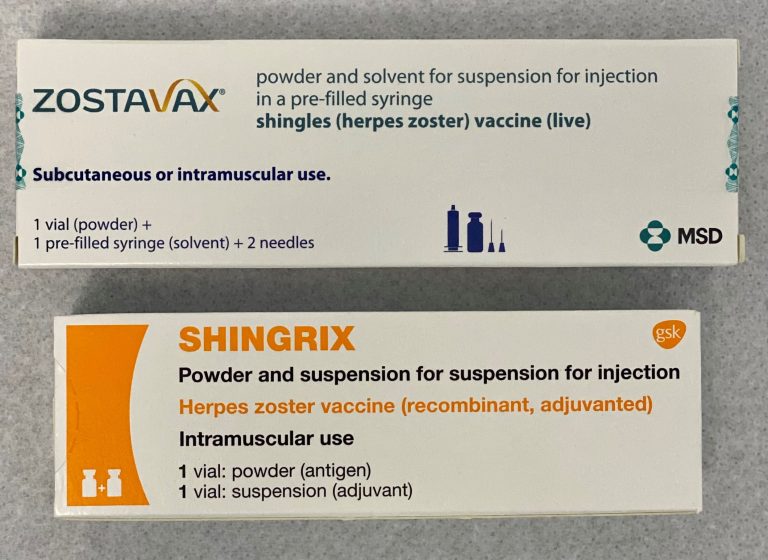

GSK’s strategic collaboration with CureVac for developing mRNA vaccines highlights the company’s continued investment in innovation, positioning it favorably in the rapidly evolving pharmaceutical landscape. However, with the global pharmaceutical market’s inherent uncertainties, investors should remain vigilant about regulatory challenges and competitive pressures.

In essence, GSK offers a blend of stability through its dividend yield and potential growth through strategic collaborations, yet the cautious analyst outlook and valuation uncertainties necessitate a balanced investment approach. For investors with a keen eye on healthcare stocks, GSK remains a compelling choice, warranting close monitoring of its strategic developments and market performance.