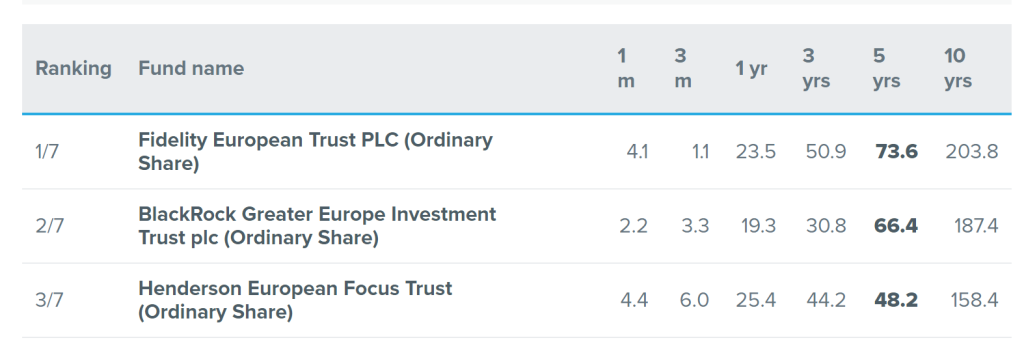

Over both 5 year and 10 year periods, Citywire rank Fidelity European Trust plc (with the LSE ticker LON:FEV) as the top European investment trust by share price performance. It’s share price has grown 73.6% over 5 years from 31/07/2018 to 31/07/2023 and 203.8% over 10 years from 31/07/2013 to 31/07/2023. This makes FEV the number 1 capital growth stock amongst European investment trusts over both periods.

BlackRock Greater Europe Investment is second and Henderson European Focus Trust is third over the same periods.

Source: Citywire Investment Trust insider

June 2023 factsheet commentary

Fidelity European Trust PLC (LON:FEV) is a European investment trust. It aims to be the cornerstone long-term investment of choice for those seeking European exposure across market cycles.