Boku, Inc. (LON:BOKU), a leading global provider of mobile payment solutions, has announced that its Malaysian entity, Boku Network Services MY Sdn. Bhd., has received authorisation from Bank Negara Malaysia to operate as a Non-Bank Merchant Acquirer. Boku MY’s approval follows continued investment by the Group in the Malaysian market over many years.

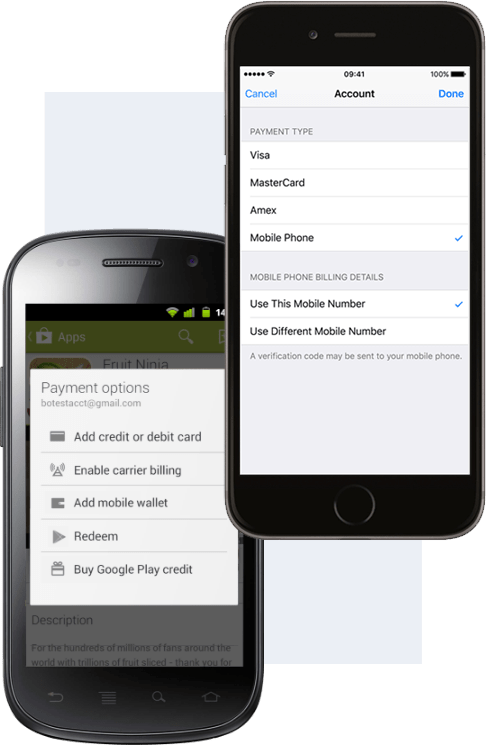

Malaysia is at the forefront of ‘new generation’ payment methods, with a high degree of mobile wallet penetration and use. DuitNow, the local MY payment scheme, as well as the Malaysian account-to-account payment scheme, Financial Process Exchange (FPX), lead Southeast Asia schemes with the availability of gold-standard features, such as variable recurring payments (VRP) with DuitNow AutoDebit.

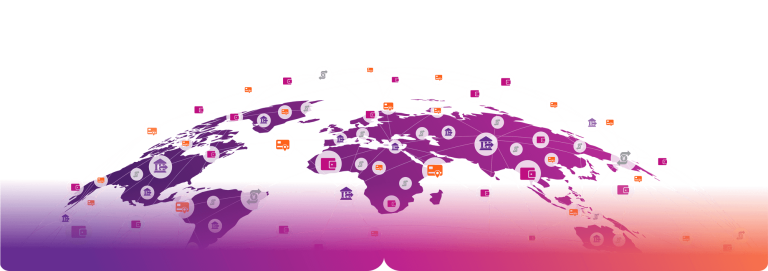

Boku MY’s authorisation from BNM will permit Malaysian merchants to access the wider Boku payments network covering 200+ payment methods around the world, supporting access to innovative financial services and enhancing business expansion routes for Malaysian companies. The authorisation will also further promote consumer payment choice in Malaysia with respect to purchases from both domestic and international merchants that partner with Boku.

Jon Prideaux, Boku’s CEO, commented, “With its vibrant fintech ecosystem, supportive regulatory environment, and high mobile and internet penetration, Malaysia is important in Boku’s global plans to transform the payment ecosystem towards the new generation of payments.”

Mark Stannard, Boku’s CBO, commented, “The receipt by Boku MY of its authorisation from Bank Negara Malaysia to operate as a Non-Bank Merchant Acquirer is a meaningful addition to Boku’s extensive network of payment licences. Our expansion in Malaysia is a further example of delivering the quality connections we are known for.”