CyanConnode Holdings plc (LON:CYAN) has steadily been making progress in India, where the national smart meter programme has been gathering pace. In July 2022, the company crossed the one million mark for meters connected to its RF network across nine Indian states. This is the aggregate RF device number in India connected since 2014 and represents market share of 22%. The latest update from the company states an order book of 2.6m RF nodes for India. Performance of smart meters is a critical aspect of the Indian programme and CyanConnode’s uptime rates of over 99% are industry-leading metrics. There remain around 41m meter deployments to be awarded in India this financial year.

- Maintaining strong contract win momentum: An important aspect of the revenue growth going forward is the healthy regional balance, with a significant proportion of FY23 revenue expected to come from the Middle East region, where the company is establishing a strong presence with the major utilities.

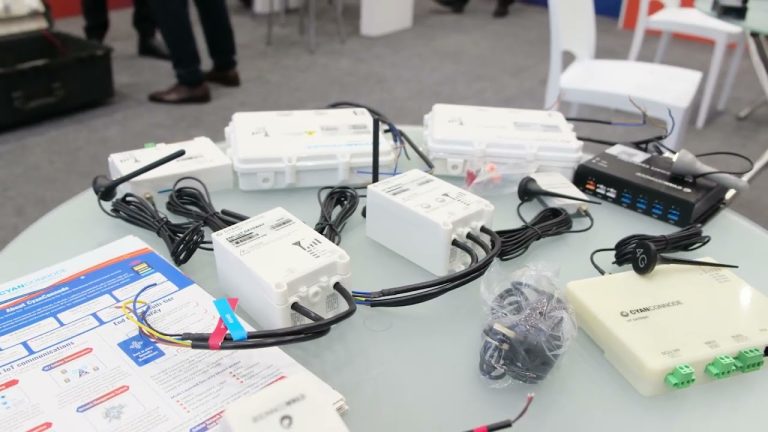

- FY22 was another strong year for shipments: 612,000 modules were shipped during FY22, up 27% YoY versus c.481,000 shipped in FY21. We anticipate a further substantial uplift in shipments in FY23 to c.900,000, comprising gateways and end-point modules across India, Asia and the Middle East.

- New contracting frameworks in India are in place: Acceleration of tender awards is now expected following the adoption of opex-based pricing models. The distribution companies will pay on a recurring basis, creating improved revenue visibility for vendors and reducing unpredictability of the timing of cash receipts.

- Financial estimates anticipate strong growth: Our forecasts anticipate 26% revenue growth in FY23, having incorporated the greater element of revenue recognition in the Indian contracts post the implementation phase. We also assume pricing discounts as large contracts are becoming the norm.

- Investment summary: The flow of contracts from India is accelerating, as reflected in the backlog of 1.6m units. There is scope for significant news flow on this front over the coming months. These are complex contracts and require the company to scale rapidly, which it is doing seamlessly against a challenging supply chain backdrop. Our DCF-implied fair equity value for CyanConnode is £63.7m (£0.27 per share), vs. the current market capitalisation of £26.7m.