Boku, Inc. (LON:BOKU), a leading global provider of mobile payment solutions, has announced that its Indian entity, Boku Network Services IN Pvt. Ltd., has received an in-principle authorisation from the Reserve Bank of India to operate as a Payment Aggregator in India. This is expected to accelerate the growth of local payment acceptance in India via Boku IN, permitting greater choice of payment for Indian consumers vis-à-vis Boku merchants.

Boku IN’s in-principle approval follows continued investment by the Group in India. Boku has been operating in the Indian market for more than ten years, and Boku IN’s Mumbai office by headcount represents one of the largest offices in Boku’s global business.

India leads the world in local payments, with the RBI sponsored Unified Payments Interface acting as a global trend-setter. Boku wholeheartedly shares the vision of the RBI of ‘E-Payments for Everyone, Everywhere, Everytime’, and strongly believes the PA-PG authorisation of Boku IN will support this.

Jon Prideaux, Boku Inc’s CEO, commented, “India will soon be the country with the largest population in the world and has a well-established local payments market. The RBI granting to Boku IN the in-principle authorisation to operate as a Payment Aggregator is an important achievement for Boku in a large and rapidly growing market, enabling us to help our customers reach new Indian consumers who increasingly rely on local digital payment methods.”

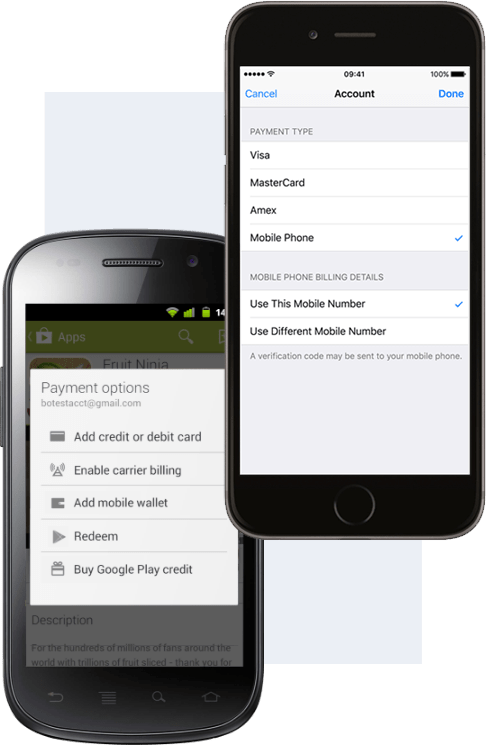

Boku Inc. (LON: BOKU) is a leading global provider of mobile payment solutions. Its mobile-first payments network provides multiple mobile payment methods, including mobile wallets, direct carrier billing, and real-time payments schemes, reaching over 7 billion mobile payment accounts in 91 countries – all through a single integration.

Customers that trust Boku to simplify sign-up, acquire new paying users and prevent fraud include global leaders such as Amazon, Apple, Facebook, Google, Microsoft, Netflix, PayPal, Sony, Spotify and Tencent.