Sequoia Economic Infrastructure Income Fund Limited (LON:SEQI) has announced it monthly factsheet & commentary for August 2025.

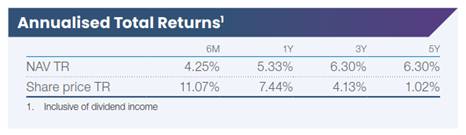

The NAV per share for SEQI, the largest LSE listed infrastructure debt fund, increased to 92.48 pence per share from the prior month’s NAV per share of 91.82 pence, representing an increase of 0.66 pence per share.

| pence per share | |

| 31 July NAV | 91.82 |

| Interest income, net of expenses | 0.78 |

| Asset valuations, net of FX movements | -0.14 |

| Subscriptions / share buybacks | 0.02 |

| 31 August NAV | 92.48 |

No expected material FX gains or losses as the portfolio is approximately 100% currency-hedged. However, the Company’s NAV may include unrealised short-term FX gains or losses, driven by differences in the valuation methodologies of its FX hedges and the underlying investments – such movements will typically reverse over time.

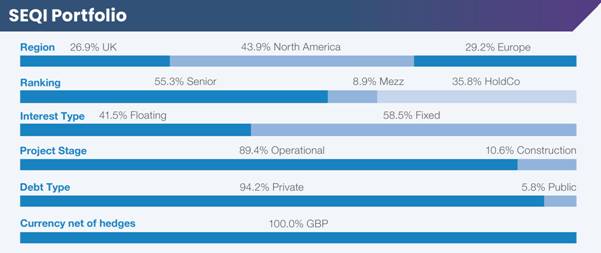

Well positioned to benefit from current high interest rates; 58.5% of the portfolio is in fixed rate investments as of August 2025.

Market Summary

Interest Rate Announcements and Inflation

| · | During August, the Bank of England reduced the base rate by 0.25% to 4.0%. Market participants now expect just one more rate cut before the end of the year, reflecting persistent inflationary pressures and potential tax increases in the Autumn Budget (scheduled for late November) to plug the fiscal deficit. As a result, 10-year UK Gilts experienced an uptick of 0.20% to 4.70% by the month-end. Following the month end, there was a sharp sell-off in government bond markets with 30-year Gilt yields reaching their highest levels since 1998, reflecting market concerns on the large fiscal deficit. |

| · | In contrast, the 10-year yields on German Bunds remained stable during the month as the ECB is expected to hold its policy rate at 2.0% in its upcoming September meeting given sluggish growth in the Eurozone and the impact from the U.S. – E.U. agreement on tariffs kicking in. |

| · | In the U.S., the yield on 10-year Treasuries trended up to c.4.30% in mid-month before closing at 4.20% at month-end, after the Federal Reserve signalled the likelihood of a further rate cut in September. |

| · | Despite credit markets remaining broadly flat during the month, the valuation of most U.S. based fixed rate instruments increased, due to a reduction in U.S. base rates. These gains were offset by the valuation of the Company’s U.K. fixed rated investments, which declined due to an increase in base rates. |

| · | In the near term, de-escalation of trade tensions is expected to help ease inflationary pressures. However, the impact of pre-tariff inventory building has made it harder to assess the true effect of tariffs on inflation and growth. Central banks are treading a very difficult tightrope between avoiding a recession and not reigniting inflation. |

| · | The pace and size of any interest rate changes will vary across the Company’s different investment jurisdictions. In the U.S., market participants currently expect a 0.25% cut in September, with further easing likely through the first quarter of 2026. In the U.K., inflation remains elevated, and the Bank of England is now widely expected to hold rates at current levels through early 2026. In the Eurozone, the European Central Bank is similarly anticipated to maintain its current rate stance, with policy broadly on hold unless inflation abates further. |

Tariff Impact & Geopolitical Analysis

| · | Trade relations held steady during August. After the U.S.- E.U. agreement in July and the 11 August executive order extending the U.S. tariff pause to November, U.S.- China negotiations also remained on hold, with no new tariffs from the U.S. and no retaliatory measures from China. This broader easing of pressure helped sustain investor confidence and supported liquidity in secondary markets. |

| · | The steadier backdrop encouraged new issuance in credit markets, particularly among industrials and infrastructure-linked companies, which benefitted from reduced headline risk. |

| · | Looking ahead, U.S.- China trade policy remains a source of potential volatility in Q4. Market reactions to tariff-related headlines are likely to continue, though not at the intensity seen earlier in 2025. |

Portfolio Update

Revolving Credit Facility and Cash Holdings

| · | As of 31 August 2025, the Company had drawn £105.7 million on its revolving credit facility of £300.0 million and had cash of £17.5 million (inclusive of interest income), and net undrawn investment commitments of £93.7 million. The revolving credit facility is utilised for liquidity management and bridging purposes, rather than as a form of structural leverage. |

Portfolio Composition

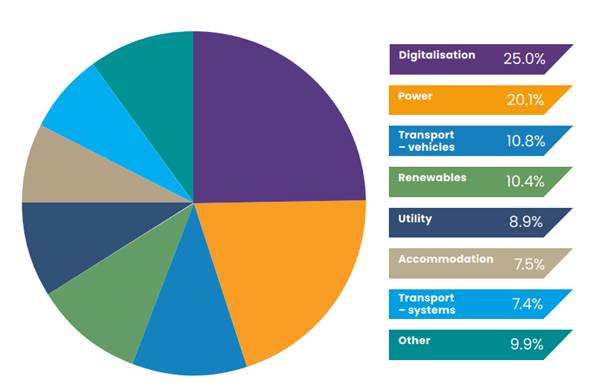

| · | The Company’s invested portfolio consisted of 56 private debt investments and 3 infrastructure bonds, diversified across 8 sectors and 29 sub-sectors. |

| · | 55.3% of the portfolio is comprised of senior secured loans reflecting the Company’s defensive positioning. |

| · | It had an annualised yield-to-maturity (or yield-to-worst in the case of callable bonds) of 10.11% and a cash yield of 7.43% (excluding deposit accounts). |

| · | The portfolio pull-to-par, which is incremental to NAV as loans mature, is 3.8 pence per share as of August 2025. |

| · | The weighted average loan life is 3.1 years as of August. |

| · | Private debt investments represented 94.2% of the total portfolio, allowing the Company to capture illiquidity yield premiums. |

| · | Sequoia Economic Infrastructure Income Fund’s portfolio remains geographically diversified with 43.9% located across the U.S., 26.9% in the U.K. and 29.2% in Europe. |

Portfolio Highly Diversified by Sector and Size

Share Buybacks

| · | The Company bought back 1,584,669 of its ordinary shares at an average purchase price of 79.69 pence per share in August 2025. |

| · | The Company first started buying back shares in July 2022 and has bought back 228,265,637 ordinary shares as of 31 August 2025, with the buyback continuing into September 2025. This share repurchase activity by the Company continues to contribute positively to NAV accretion. |

New Investment Activity During August 2025

| · | A senior secured loan for €14.1 million and total commitments of €55.558 million to finance the construction of a portfolio of ready-to-build Solar P.V. plants in Poland. Poland continues to robustly support the transition of its coal-dependant energy system and remains committed to its ambition of achieving long-term energy security and energy sustainability. The loan, which has a legal maturity of 3 years, is projected to deliver a YTM of approximately 8.9%. The transaction benefits from robust credit protections and strong track record of the sponsor in owning and operating renewable power assets in Europe. |

| · | An additional senior loan for $21.6 million to GenOn Bowline, to participate in the refinancing/upsizing of the loan. SEQI’s total settled position on this loan is for $50 million. GenOn Bowline is a 1,145 MW natural gas and oil-fuelled power generation facility located in the greater New York City region. The YTM on this loan is 10.55%. |

| · | An additional Holdco loan to Sunrun for $9.45 million. The borrower is a leader in the U.S. residential solar market. The YTM on this loan is 13.44%. This loan forms part of an upsize to the warehousing facility, with SEQI’s commitment increasing from $46m to $65m in March. SEQI’s settled loan balance was $36.5 million as of 31 August. The facility supports Sunrun in purchasing residential solar equipment ahead of the expiration of solar investment tax credits in 2027. |

| · | An additional senior loan to ACG BidCo for £13.5 million, a U.K. national provider of accommodation and complex care services. The YTM on this loan is 15.95%. Since SEQI became the majority equity owner of Active Care Group (“ACG”) in May 2024, the company has made meaningful operational and financial progress against its turnaround strategy. This has been evidenced in part by CQC inspection ratings over the past 12 months, with 100% of services rated “Good” or “Outstanding,” and ACG’s return to operational profitability. As part of the turnaround strategy, ACG is implementing an asset optimisation programme designed to strengthen its balance sheet and invest in better aligning its portfolio with long-term growth opportunities, including in private neuro-rehabilitation facilities. SEQI believes this asset optimisation programme should enable ACG’s management to increase the value of the business and thereby support recovery of the loan and upside potential for the business. To further support the turnaround strategy, and to provide the capital expenditure required for repositioning existing assets towards private neuro-rehabilitation facilities, SEQI has advanced this additional new funding to ACG. SEQI is in active discussions with co-lenders regarding their participation in this funding round. SEQI’s total exposure to ACG following the provision of this new funding is £88.8m or 6.0% of NAV making it SEQI’s largest exposure. The Board and Investment Adviser, with the support of the AIFM, will continue to closely monitor this and consider the strategy to manage the position to maximise value in the future. |

Investments that repaid during August 2025

| · | A full repayment of SEQI’s senior loan to Workdry for £50 million. The borrower is the U.K.’s leading provider of essential and emergency water handling infrastructure solutions. |

Non-performing Loans

| · | Sequoia Economic Infrastructure Income Fund continues to work towards maximising recovery from the non-performing loans in the portfolio (equal to 0.6% of NAV). There are no additional announcements of non-performing loans this month. |

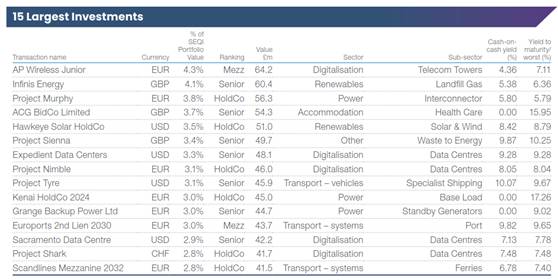

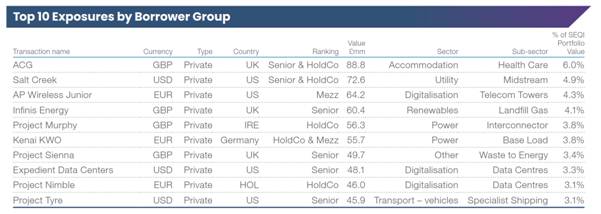

Top Holdings

Valuations are independently reviewed each month by PWC.

Full list of SEQI’s Portfolio Holdings and SEQI Monthly Factsheet:

http://www.rns-pdf.londonstockexchange.com/rns/2325Z_2-2025-9-13.pdf

About Sequoia Economic Infrastructure Income Fund Limited

| · | SEQI is the U.K.’s largest listed debt investor, investing in economic infrastructure private loans and bonds across a range of industries in stable, low-risk jurisdictions, creating equity-like returns with the protections of debt. |

| · | It seeks to provide investors with regular, sustained, long-term income with opportunity for NAV upside from its well diversified portfolio. Investments are typically non-cyclical, in industries that provide essential public services or in evolving sectors such as energy transition, digitalisation or healthcare. |

| · | Since its launch in 2015, SEQI has provided investors with ten years of quarterly income, consistently meeting its annual dividend per share target, which has grown from 5 pence in 2015 to 6.875 pence per share. |

| · | The fund has a comprehensive sustainability framework combining sustainability goals, a proprietary ESG scoring methodology, alongside processes and metrics with alignment to key global initiatives. |

| · | SEQI is advised by Sequoia Investment Management Company Limited (SIMCo), a long-standing investment advisory team with extensive infrastructure debt origination, analysis, structuring and execution experience. |

| · | SEQI’s monthly updates are available here: Monthly Updates – seqi.fund/investors/monthly-updates |

|