Raspberry Pi Holdings plc (LON: RPI), a leader in low-cost, high-performance computing, has issued a trading update for its financial year ended 31 December 2024.

Group trading performance

As anticipated at the interim results in September, elevated customer and channel inventory levels continued to normalise in the second half of the year. Monthly unit shipments recovered steadily from their low point in the summer, with total Single-Board Computer and Compute Module shipments reaching 7.0 million across FY 2024. Gross profit from the sale of accessories and microcontrollers was strong in the second half and this, together with good cost discipline, means the Board expects to report (subject to external audit) adjusted EBITDA of not less than $36m for FY 2024.

Cash at 31 December 2024 was c.$45m after strategic purchases of components and continued investment in the Company’s product roadmap.

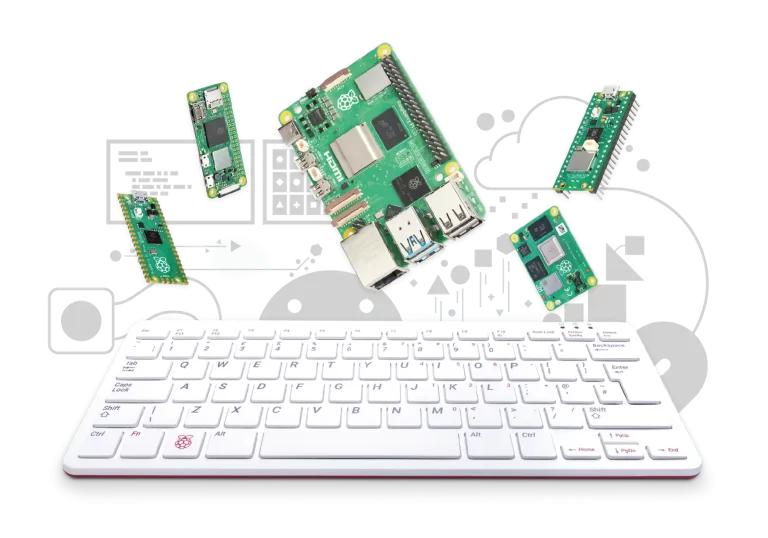

Product launches in the second half included Pico 2 (August), Compute Module 5 (November), and a variety of well-received accessories; more than twenty new products were released in the year. Raspberry Pi expects to realise the full benefit of these launches in 2025. The Company was particularly pleased to announce Compute Module 5 design wins with long-standing OEM customers at launch, as well as a new long-term strategic design partnership with SECO, both highlighting the progress of Raspberry Pi’s direct-to-OEM strategy.

Outlook

Looking ahead, Raspberry Pi expects demand to build gradually through the year, despite a challenging macroeconomic backdrop and market conditions reported by the wider industrial sector. Medium-term fundamentals remain extremely positive. The Company has a sufficient supply of memory to meet expected demand into Q3 of this year, giving it confidence in its unit economics for FY 2025. In addition, the Company is encouraged by an increasing number of direct discussions with major prospective OEM customers.

Notice of results

The Group will report its FY 2024 results on Wednesday, 2 April 2025.

Eben Upton, CEO of Raspberry Pi said:

“We are proud of the Group’s performance in our first year as a PLC, achieving significant milestones, including listing the company on the London Stock Exchange, our inclusion in the FTSE 250 index, and the successful launch of key products, against a backdrop of challenging end-market demand. We have worked hard to launch a variety of accessory products aimed at our Education and Enthusiast customers and are pleased with the progress we are making in the Industrial and Embedded market. With an exciting product roadmap and ongoing initiatives to strengthen our market position, we look to the future with confidence and are excited about the opportunities that lie ahead.”