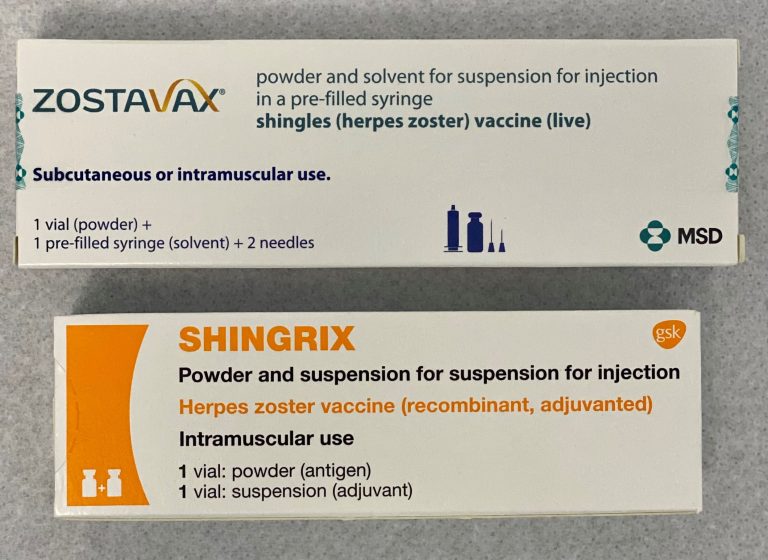

GSK plc (NYSE: GSK), a stalwart in the global healthcare sector, commands a significant presence in the drug manufacturing industry with a market capitalization of $95.49 billion. Headquartered in London, GSK is known for its robust portfolio of vaccines and specialty medicines, solidifying its status as a pivotal player in both the United Kingdom and international markets.

Currently trading at $47.18, GSK’s stock has experienced a modest dip of 0.54 (-0.01%) but remains within a strong 52-week range of $32.08 to $48.41. Investors should note that despite the recent price fluctuation, GSK’s stock is relatively close to its 52-week high, suggesting a resilient market performance.

A standout feature in GSK’s valuation is its forward P/E ratio of 9.71, which positions it attractively against industry peers, indicating potential undervaluation. However, other valuation metrics such as PEG, Price/Book, and Price/Sales ratios are not available, which may call for cautious optimism when evaluating the stock purely on traditional valuation grounds.

GSK’s financial health is further underscored by a commendable revenue growth rate of 6.70% and a robust return on equity of 41.52%. This is complemented by a strong free cash flow of approximately $3.75 billion, demonstrating the company’s ability to generate cash and sustain operations efficiently. The earnings per share (EPS) stands at 3.50, reflecting solid profitability despite the absence of net income data.

For income-focused investors, GSK offers a dividend yield of 3.58%, with a payout ratio of 47.40%, suggesting a well-balanced approach to rewarding shareholders while retaining earnings for future growth.

Analyst sentiment towards GSK is mixed, with 2 buy ratings, 4 hold ratings, and 2 sell ratings. The target price range of $40.00 to $58.00, coupled with an average target price of $47.61, indicates a potential upside of 0.91%. This marginal upside suggests that GSK is relatively fairly valued at its current trading price.

Technical indicators present a nuanced picture. GSK’s RSI (14) at 74.78 suggests that the stock might be overbought, aligning with its proximity to the upper end of its 52-week range. The MACD at 1.26 compared to the signal line at 1.22 further supports this view, pointing towards potential consolidation or a correction in the near term.

GSK’s strategic initiatives, including its collaboration with CureVac and a strategic alliance with AN2 Therapeutics, Inc., highlight its commitment to innovation and expanding its therapeutic capabilities. These partnerships, particularly in mRNA vaccine development and tuberculosis therapies, position GSK to leverage emerging healthcare trends and address critical global health challenges.

Founded in 1715, GSK’s rich history is matched by its strategic vision and operational excellence. For investors, GSK offers a blend of stability and growth potential, driven by its diversified product portfolio and strategic collaborations. While the immediate upside may appear limited, the company’s strong fundamentals and strategic positioning make it a compelling consideration for long-term investors seeking exposure to the healthcare sector.