Investors with an eye on the healthcare sector may find GSK plc (NYSE: GSK) an intriguing prospect. With a robust market capitalization of $98.43 billion, this United Kingdom-based pharmaceutical giant is a key player in the drug manufacturing industry, specializing in vaccines, specialty, and general medicines. As GSK navigates the challenges and opportunities in this dynamic landscape, let’s delve into its financial performance and what it might mean for investors.

**Current Market Performance and Valuation Metrics**

GSK’s current stock price hovers around $48.61, marking a slight increase of 0.32 USD, which is just a 0.01% change. This price positions the stock close to its 52-week high of $49.24, reflecting a steady upward trend from a low of $32.08. The stock’s forward P/E ratio stands at a reasonable 10.44, suggesting that investors are paying a moderate price for future earnings, a promising sign for those considering long-term investment.

**Strong Performance Metrics**

The company’s financial health is underscored by a noteworthy return on equity (ROE) of 41.52%, indicating effective management and profitable use of shareholder funds. Moreover, with revenue growth at 6.70%, GSK continues to demonstrate its capability to expand its business operations successfully. The company’s free cash flow of approximately $3.75 billion further bolsters its financial stability, providing ample flexibility for reinvestment or dividend distribution.

**Dividend and Analyst Ratings**

GSK offers a compelling dividend yield of 3.48%, with a payout ratio of 47.40%, striking a balance between rewarding shareholders and retaining earnings for growth. This attractive yield is a key consideration for income-focused investors looking to add stable dividend-paying stocks to their portfolios.

Analyst sentiment around GSK is mixed but leans towards cautious optimism. With two buy ratings, five hold ratings, and one sell rating, the consensus suggests a stable outlook. The average target price of $49.35 implies a modest potential upside of 1.51%, indicating that the stock may be fairly valued at its current price.

**Technical Indicators and Market Trends**

From a technical standpoint, GSK’s 50-day moving average of $46.72 and its 200-day moving average of $40.89 signal positive momentum. However, the Relative Strength Index (RSI) at 36.65 suggests the stock is approaching oversold territory, potentially presenting buying opportunities for vigilant investors. Additionally, the MACD indicator of 0.58 against a signal line of 0.67 may hint at a forthcoming bullish crossover.

**Strategic Alliances and Growth Prospects**

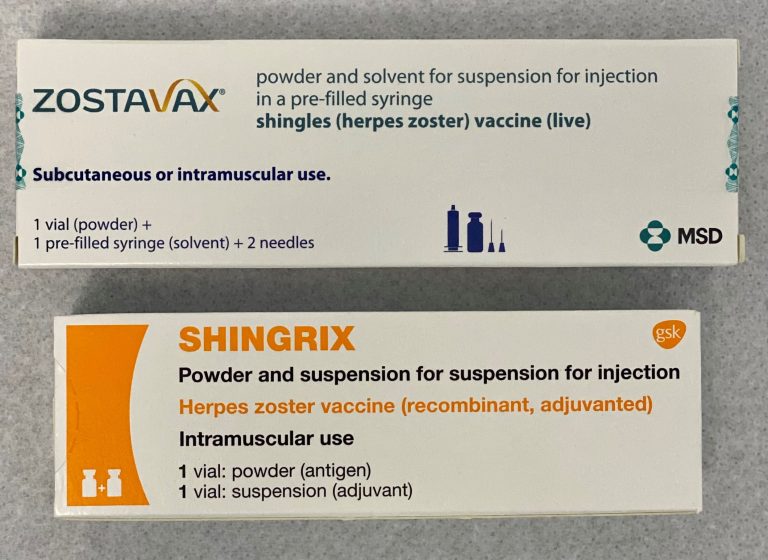

GSK continues to enhance its product pipeline through strategic collaborations, such as its partnership with CureVac to develop mRNA vaccines and its alliance with AN2 Therapeutics, Inc. for TB therapies. These initiatives underscore GSK’s commitment to innovation and its pursuit of long-term growth in the highly competitive pharmaceutical landscape.

**Conclusion for Investors**

GSK plc presents a mix of stability through its established market presence and potential growth through strategic partnerships and innovation. For investors, the stock offers a reasonable dividend yield alongside moderate growth prospects. While current valuations suggest cautious optimism, the company’s strong ROE and robust cash flow provide a solid foundation for future performance. Investors should continue to monitor GSK’s strategic developments and market conditions to make informed decisions about their investment in this healthcare leader.