GSK plc (NYSE: GSK), a stalwart in the healthcare sector, stands as a major player within the drug manufacturers’ industry. Headquartered in London, the company has established a global footprint by developing and manufacturing a wide range of vaccines, specialty medicines, and general medicines. With a market capitalization of $83.2 billion, GSK has captured the attention of investors, particularly those intrigued by its considerable dividend yield and strategic collaborations.

Currently trading at $41.03, GSK’s share price has seen a modest increase of 0.03%, reflecting stability within its 52-week range of $32.08 to $44.26. This performance aligns with its technical indicators, showing a 50-day moving average of $37.58 and a 200-day moving average of $37.55, suggesting a consistent upward trend in its valuation over the past year. However, with an RSI of 45.30, the stock is neither oversold nor overbought, indicating a balanced market sentiment.

GSK’s forward P/E ratio sits at a competitive 8.51, suggesting that investors are paying a reasonable price for future earnings, especially in a sector known for its growth potential. Despite the absence of trailing P/E and PEG ratios, GSK’s forward-looking metrics present a compelling case for value investors seeking steady returns in the healthcare industry.

The company reported a revenue growth of 2.10%, underlining its capacity to expand even in a challenging economic environment. A robust return on equity of 27.10% further highlights its efficiency in generating profits from its equity base. GSK’s free cash flow of over $5.1 billion provides the financial flexibility to support ongoing research and development initiatives, crucial for maintaining its competitive edge in innovative vaccine and medicine production.

Investors looking for income will find GSK’s dividend yield of 3.90% attractive, complemented by a payout ratio of 79.84%. This demonstrates the company’s commitment to returning value to shareholders while sustaining its growth trajectory. Such a yield is particularly appealing in today’s low-interest-rate environment, offering a reliable income stream from a well-established company.

Analyst sentiment on GSK is mixed, with two buy ratings, four hold ratings, and two sell ratings. The target price range of $35.25 to $58.00, with an average target of $41.54, suggests a potential upside of 1.23%. This modest upside reflects the market’s cautious optimism, likely influenced by broader industry challenges and the competitive landscape.

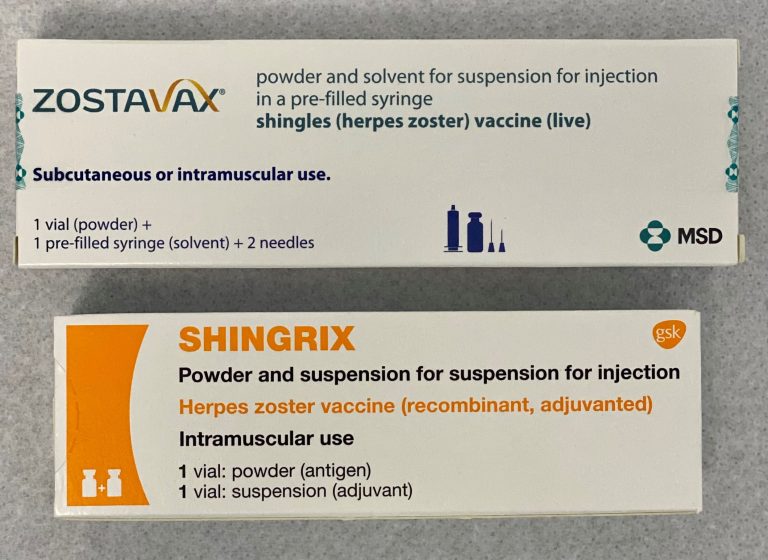

GSK’s collaboration with CureVac to develop mRNA vaccines underscores its strategic focus on innovation and addressing global health needs. This partnership enhances its pipeline, potentially driving future growth and fortifying its position in the vaccine market.

As GSK continues to navigate the complexities of the healthcare sector, investors should keep a keen eye on its strategic initiatives and the evolving regulatory landscape. The company’s long-standing history and diversified product portfolio provide a solid foundation, making GSK a noteworthy consideration for those seeking a blend of growth, income, and stability in their investment portfolios.