GSK plc (NYSE: GSK) stands as a formidable player in the healthcare sector, with a market capitalization of $78.44 billion. Headquartered in London, GSK’s reach is global, engaging in the development and manufacture of vaccines and medicines that address a wide range of diseases. As the company continues to leverage its extensive research and development capabilities, investors are keenly evaluating its current market standing and future growth potential.

The stock is currently trading at $38.66, close to the midpoint of its 52-week range of $32.08 to $44.77. Over the past year, GSK has demonstrated steady growth, highlighted by a revenue increase of 2.10%. However, its price movement has been relatively stagnant with a minor price change of -0.01% recently.

Valuation metrics tell an intriguing story for GSK. The company’s forward P/E ratio stands at an attractive 8.11, signaling potential undervaluation, especially in comparison to the broader healthcare sector. However, other common valuation metrics such as the PEG Ratio and Price/Book are currently unavailable, which may suggest some uncertainty regarding future growth and profitability projections.

Despite these uncertainties, GSK’s performance metrics offer reasons for investor optimism. The company boasts an impressive return on equity of 27.10%, indicating efficient management of shareholder equity to generate earnings. Moreover, GSK’s robust free cash flow of over $5.16 billion underscores its financial health and ability to sustain operations and dividends.

Speaking of dividends, GSK offers a yield of 4.14%, coupled with a payout ratio of 79.84%. This payout ratio reflects the company’s commitment to returning capital to shareholders while balancing reinvestment in its core business operations.

When it comes to analyst sentiment, GSK has garnered mixed reviews. The stock currently holds 2 buy ratings, 4 hold ratings, and 2 sell ratings. Analysts have set a target price range between $35.25 and $58.00, with an average target of $41.59, suggesting a potential upside of 7.59% from its current price. This indicates that while opinions vary, there is a general consensus that GSK has room to grow.

Technical indicators present a mixed picture. The stock’s 50-day and 200-day moving averages are almost aligned at $37.58 and $37.55, respectively, suggesting a neutral trend. The RSI (14) stands at 26.51, typically viewed as an indicator of oversold conditions, which might imply a potential buying opportunity for contrarian investors. Meanwhile, the MACD and Signal Line values of 0.31 and 0.16, respectively, show a positive crossover, which some traders interpret as a bullish signal.

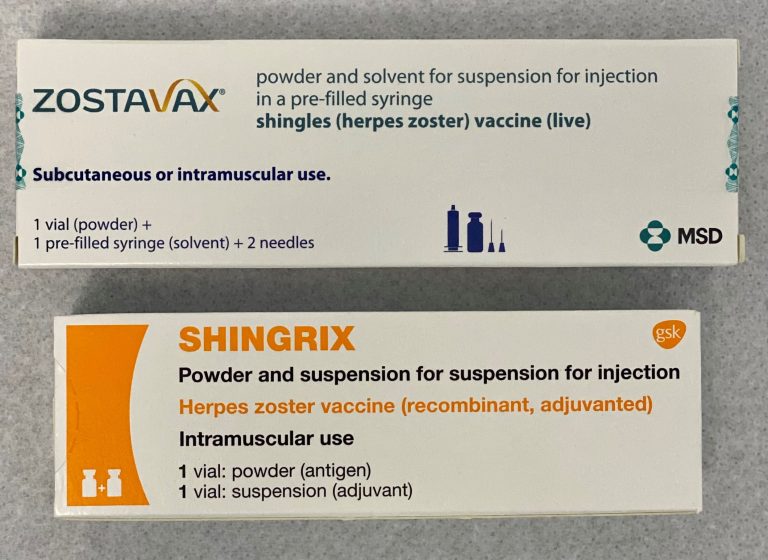

GSK continues to innovate with a focus on strategic partnerships, including its collaboration with CureVac to develop mRNA vaccines. This aligns with the company’s commitment to expanding its product pipeline and staying at the forefront of medical advancements.

For investors, GSK offers a blend of stability and potential growth. Its significant market presence, coupled with a strong dividend yield, makes it an attractive option for income-focused portfolios. However, prospective investors should remain cognizant of the mixed analyst sentiment and the absence of some valuation metrics when making investment decisions. As the healthcare industry evolves, GSK’s strategic initiatives and financial resilience will be critical in maintaining its competitive edge and delivering shareholder value.