DirectorsTalk caught up with Alexa Henderson, Chairman of JPMorgan Japan Small Cap Growth and Income Trust plc (LON:JSGI), following the UK government announcement of the dividend income tax increase.

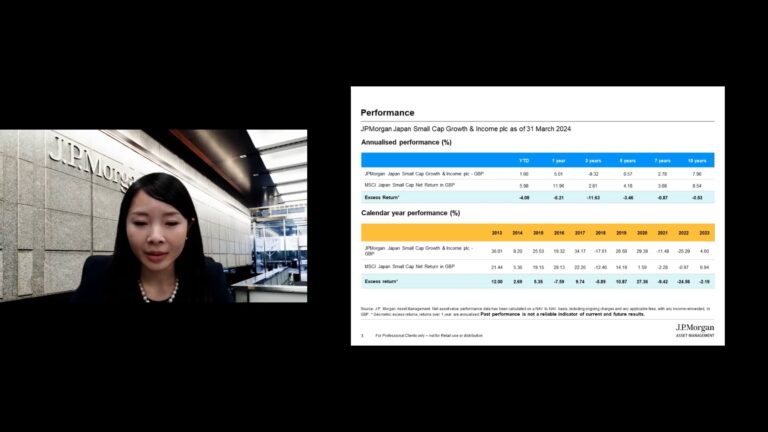

Alexa noted: ‘As Investors, we all know the pandemic has put a heavy toll on government finances worldwide, and there will increasingly be measures to repair the damage. This might be a catalyst for potential investors to review their dividend income options. JPMorgan Japan Small Cap Growth and Income (JSGI) targets income without compromising on Japanese growth opportunities. The company pays a quarterly dividend equivalent to 1% of its net asset value, set on the last business day of each financial quarter. The last twelve months have been an excellent period for the company as we have raised the dividend by 22.4% over the last twelve months, such that at the 7thof September (source Bloomberg) the historic dividend yield is 4.18%. The company´s website provides much more detail of the portfolio construction, risks, charges, the ESG integration and the manager’s outlook where he describes how new businesses are revitalising the Japanese Economy.’

Japan income fund, JPMorgan Japan Small Cap Growth & Income plc (LON:JSGI / JSGI.L), targets Japan income without compromising on Japanese growth opportunities. This Japan fund is an income investing opportunity that gives investors access to a diverse and fast growing sector managed by local managers. The Investment Trust offers a regular quarterly income without compromising on Japanese growth opportunities, by paying a higher dividend funded part by capital reserves as well as revenue returns.