GSK plc (NYSE: GSK), a titan in the healthcare sector, continues to capture investor attention with its dynamic role in the drug manufacturing industry. Based in the United Kingdom, GSK maintains a formidable market presence with a market capitalization of $77.95 billion. As the company navigates the complexities of pharmaceuticals and vaccines, investors are keenly watching its stock trajectory, especially given the projected 9.10% upside potential.

The current stock price of GSK stands at $38.07, with a slight decrease of 0.57% recently, placing it comfortably within its 52-week range of $32.08 to $44.26. Despite this modest fluctuation, analysts have set a target price range between $35.25 and $58.00, with an average target of $41.54, underscoring the potential for growth in the near term.

From a valuation perspective, GSK’s forward P/E ratio is an attractive 7.83, suggesting that the stock is reasonably priced relative to its earnings growth potential. Although the PEG, Price/Book, and Price/Sales ratios are not available, the forward P/E offers a glimpse into the company’s profitability outlook. Moreover, GSK boasts a robust return on equity of 27.10%, reflecting efficient management of shareholder investments.

Performance metrics reveal a modest revenue growth of 2.10%, with earnings per share (EPS) at 2.04. GSK’s financial health is further underscored by its substantial free cash flow of over $5.16 billion, providing the company with the flexibility to invest in research, development, and expansion initiatives.

Dividend-seeking investors will find GSK’s 4.20% yield appealing, supported by a payout ratio of 79.84%. This indicates a commitment to returning value to shareholders while maintaining the ability to reinvest in future growth.

Analyst ratings present a mixed sentiment, with one buy rating, five hold ratings, and two sell ratings. This distribution suggests cautious optimism among analysts, with a lean towards holding the stock as GSK continues to execute its strategic plans.

Technically, GSK’s 50-day moving average is $38.37, slightly above the current price, while the 200-day moving average is $37.44. The RSI (14) is notably low at 28.34, indicating that the stock might be oversold, which could present a buying opportunity for investors seeking to capitalize on a potential price rebound.

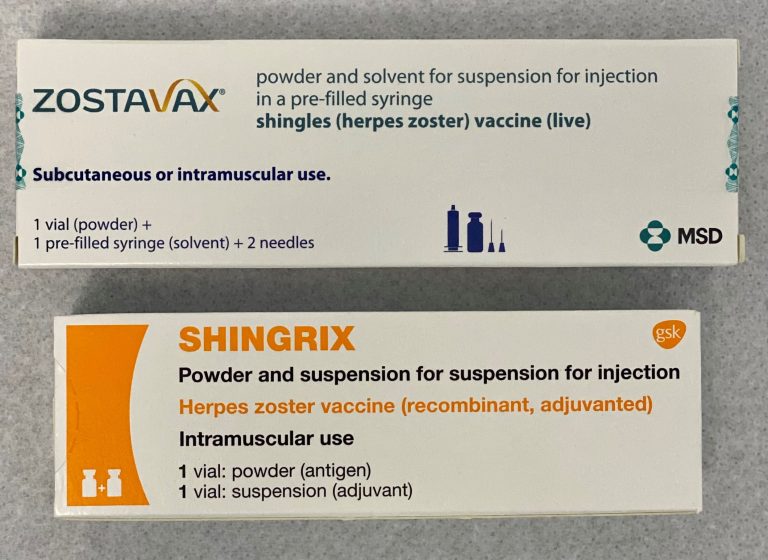

GSK’s comprehensive portfolio spans specialty medicines, vaccines, and general medicines, addressing a wide array of health concerns from oncology to respiratory diseases. The company’s strategic collaboration with CureVac in developing mRNA vaccines for infectious diseases further underscores its innovative approach in the pharmaceutical landscape.

Founded in 1715 and headquartered in London, GSK has a storied history of advancing healthcare solutions globally. As the company looks to the future, its strategic focus on vaccines and specialty medicines positions it well to leverage emerging health trends and drive shareholder value.

Investors interested in healthcare stocks with a blend of stability, dividend income, and growth potential will find GSK plc a compelling consideration. With its solid market standing and promising upside potential, GSK remains a noteworthy player on the global healthcare stage.