Thor Energy Plc (LON:THR, ASX: THR) has provided the Company’s audited annual financial results for the year ended 30 June 2025:

2025 ANNUAL REPORT

Chairman’s Message

Dear Shareholders,

On behalf of the Board of Thor Energy Plc, I am pleased to report on the activities of the Company for the year ended 30 June 2025, a truly transformative year marking the successful execution of our strategy to simplify and maximise our portfolio and focus predominantly on the ‘clean energy’ economy, specifically, our strategic focus is now firmly centered on natural hydrogen and helium exploration in South Australia.

The defining milestone of the reporting year was completion of the acquisition of an 80.2% majority

stake in Go Exploration Pty Ltd in February 2025. This acquisition gave Thor control of the HY-Range Project (RSEL 802), positioning us at the forefront of the natural hydrogen and helium exploration sector in Australia. We swiftly followed this up with the crucial conversion of the initial exploration licence (PEL 120) to a Regulated Substance Exploration Licence (RSEL 802) in March 2025, curing limitations associated with the previous petroleum licence regarding hydrogen exploration rights.

Following this transition, we commissioned RISC Advisory; leading independent consultants, to undertake a Prospective Resource Assessment. The outstanding results announced 30 March 2025, demonstrated significant potential for undiscovered accumulations which immediately accelerated our exploration schedule.

To fund this new focus and streamline our business, we successfully undertook a capital raise of approximately GBP£1,000,000 via a two-tranche placement, supported strongly by both new and existing investors. Furthermore, our commitment to rationalising the portfolio has continued post-period. This strategy was exemplified by the successful execution of two significant asset sales via Term Sheets for the sale of a 75% interest in our non-core US uranium claims to Metals One PLC and the sale of our 75% interest in the Molyhil Tungsten Project (FRAM JV) to Tivan Limited, collectively delivering almost A$9million of value to Thor over time. Additionally, we entered into a key commercial arrangement with DISA Technologies, Inc. (September 2025) to evaluate and process historically abandoned uranium mine waste dumps at the Colorado Projects, providing a path to a potential fully carried Gross Revenue Share position (2.5% to 4.0% gross revenue), as neither capital nor operating expenditure is required by Thor or its subsidiary. The monetisation of these non-core assets provides a significant, non-dilutionary boost to Thor’s cash position, enabling the Company to dedicate more resources to advancing the HY-Range Project to a drill decision.

Operationally, the Board continues to seek to minimise costs to ensure that the maximum amount of money is spent directly on our exploration programmes. In December 2024, Mr. Lincoln Moore was appointed as a Non-Executive Director and Mr. Rowan Harland was appointed as Company Secretary, aligning with our efforts to streamline operational costs. In February 2025, we welcomed Andrew Hume as Managing Director, bringing substantial global energy-sector expertise directly applicable to natural hydrogen exploration. Post-period (July 2025), Mr. Hume was appointed CEO/MD, aligning with our strategic plan for focused executive leadership, while I resumed the role of Non-Executive Chairman.

We ended the financial year on 30 June 2025 with cash and cash equivalents of A$1,459,000 (£686,000) a figure that will improve significantly as the US uranium and Molyhil divestments are taken into account.

The Board believes that this strategic transition and subsequent asset restructuring positions Thor Energy strongly to create significant value for shareholders as an early mover in the highly thematic natural hydrogen and helium sector, while maintaining exposure to critical energy metals through retained interests and equity holdings

Yours faithfully

Alastair Clayton

Chairman, Thor Enengy

26 September 2025

REVIEW OF OPERATIONS AND STRATEGIC REPORT

OPERATIONS REVIEW

The financial year 2024-2025 was dominated by the strategic pivot towards natural hydrogen and helium, significantly reshaping the Group’s portfolio and exploration focus.

Exploration and operational highlights 2024-2025:

· Successful completion of the strategic acquisition of an 80.2% majority stake in Go Exploration Pty Ltd in February 2025, positioning Thor at the forefront of the natural hydrogen and helium exploration sector in Australia.

· Conversion of the initial petroleum licence (PEL 120) to a Regulated Substance Exploration Licence (RSEL 802) in March 2025, conferring full hydrogen and helium exploration rights across the licence.

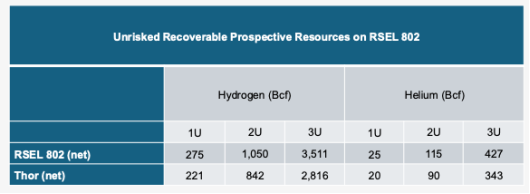

· Independent Prospective Resource Assessment by RISC Advisory (announced 30 March 2025) identified significant potential on RSEL 802, defining Thor’s net unrisked recoverable Prospective Resources (P50/2U) at 842 Bcf of Hydrogen and 90 Bcf of Helium.

· Successful completion of an upsised geochemical survey (103 sample sites) at RSEL 802 in May 2025, demonstrating prolific natural hydrogen and helium systems with concentrations locally exceeding 1,000ppm hydrogen and a high reading of 3,000ppm, and helium detected up to 27ppm.

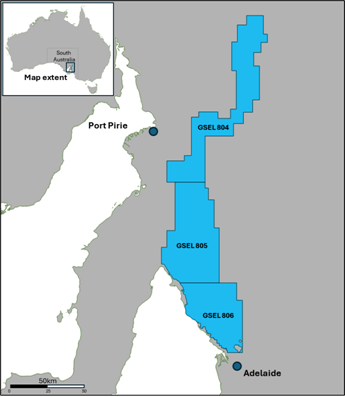

· Thor’s subsidiary accepted three new Gas Storage Exploration Licences (GSELs 804, 805, 806) in June 2025, augmenting the South Australian portfolio and offering potential commerciality synergies to advantage our natural hydrogen and helium business.

· Drilling completed at the Groundhog Mine Prospect (USA) successfully extended the known mineralised footprint by 100m to the north and 300m to the east, with intersections indicated in gamma logging up to 0.16% eU3O8 (1,574ppm) over 0.5m.

· Post-period, significant asset rationalisation was executed via Term Sheets for the sale of 75% interest in US uranium claims to Metals One PLC (for £100,000 cash and £1,000,000 stock), and the sale of Thor’s 75% interest in the Molyhil Tungsten Project (FRAM JV) to Tivan Limited (for A$6,562,500 net to Thor).

· Post-period, a Gross Revenue Sharing Term Sheet was signed with DISA Technologies, Inc. (September 2025) to process abandoned uranium mine waste dumps, providing Thor a potential fully carried direct revenue share position (ranging from 2.5% to 4.0% gross revenue), requiring no capital or operating expenditure by Thor.

NATURAL HYDROGEN AND HELIUM (HY-RANGE PROJECT – SOUTH AUSTRALIA)

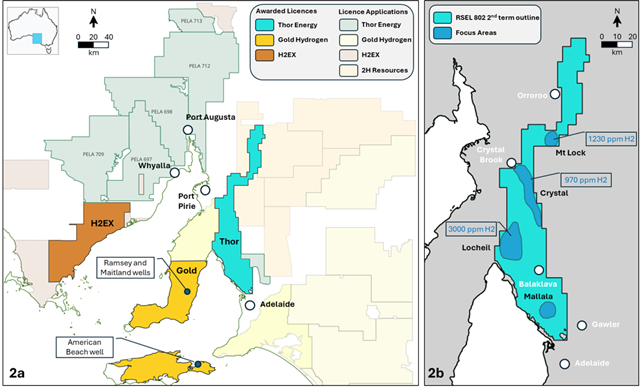

The HY-Range Project (RSEL 802) became the Company’s flagship asset following the acquisition of an 80.2% interest in Go Exploration Pty Ltd in February 2025. This granted licence is located near the Gold Hydrogen Limited Ramsay-1 and Ramsay-2 discoveries. The licence conversion from PEL 120 to RSEL 802 in March 2025 conferred full rights to explore for hydrogen and helium.

Figure 1 GSEL 804, 805, 806 Location map

The subsequent Independent Prospective Resource Assessment by RISC Advisory[1] (announced 30 March 2025) calculated Thor’s net unrisked recoverable Prospective Resources (P50/2U) at 842 Bcf of Hydrogen and 90 Bcf of Helium. A comprehensive geochemical survey (103 sample sites) was completed in May 2025, confirming high prospectivity with natural hydrogen readings up to 3,000ppm and helium readings up to 27ppm, identifying four high-grade focus areas which we term: Mallala, Lochiel, Crystal, and Mt Lock. Thor’s subsidiary accepted three new Gas Storage Exploration Licences (GSELs 804, 805, 806) in June 2025 which are ideally positioned for synergies with either short-term hydrogen of Thor and/or third-party hydrogen or natural gas, or for the sequestration of greenhouse gas storage from the urban centre of Adelaide and nearby industries.

Figure 2: Results of RISC assessment or Prospective Hydrogen and Helium Resources on RSEL 802 (Previously PEL120).

The estimated quantities of hydrogen and helium that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both a risk of discovery and a risk of development. Further exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially recoverable hydrogen and helium.

Subsequently, the key focus of our exploration efforts at the HY Range natural hydrogen and helium project was the successful completion of a full-licence geochemical sampling programme, designed to provide a further suite of data to prove working natural hydrogen and helium systems, and initiate high grading of our acreage to increase focus on drill targeting and as an aid to final drill design. As previously announced[2], the planned programme was upsized to include several new step-out locations, resulting in a total of 103 sample locations. Thor deployed field-based gas chromatography equipment, which we understand to be the first deployment of its kind for natural hydrogen and helium exploration in Australia, see Figure 3.

Figure 3: Field operations in the southern flinders area, collecting soil air geochemical analysis at Project HY-Range, May 2025.

The excellent results of the geochemical sampling programme were announced post period[3]. Analysis of the data yielded very positive results, with a high percentage of elevated hydrogen values in numerous areas of the licence, locally exceeding 1,000ppm in several locations, and up to 3,000ppm at one sample point (compared to typical background atmospheric values of 0.5ppm). Locally elevated helium readings were also recorded up to 27ppm (compared to typical background atmospheric values of 5ppm). Whilst soil gas sampling can be inherently prone to anthropogenic hydrogen contamination and sample bias, the distribution of the values strongly correlates with mapped geological features and supports the natural origin of these highly elevated readings, as shown in Figure 2a and 2b. The detection of elevated helium is unambiguous and demonstrates a working helium system.

Figure 2a illustrates the location of RSEL 802 (HY-Range) in the context of nearby Petroleum Exploration Licences (PELs) and licence applications (PELA’s), as well as nearby down-hole hydrogen/helium occurrences.

Figure 2b illustrates the four priority focus areas (Blue polygons) in the context of RSEL 802 licence (2nd term outline- black polygon).

URANIUM AND VANADIUM PROJECTS (USA)

Drilling at the Groundhog Mine Prospect (Q4, 2024) successfully extended the known mineralised footprint by 100m to the north and 300m to the east, indicating grades up to 0.16% eU3O8 over 0.5m[4]. Post-period, a Term Sheet was signed to sell 75% of the US uranium and vanadium projects (held by Standard Minerals Inc. and Cisco Minerals Inc.) to Metals One PLC (MET1) for £100,000 cash and £1,000,000 in Met1 stock[5]. Thor retains a fully carried 25% interest and has granted Met1 a 12-month option to acquire this remaining percentage. Additionally, the Gross Revenue Sharing Term Sheet signed with DISA Technologies, Inc. established a pathway for generating revenue from abandoned uranium mine waste dumps, with Thor entitled to a Gross Revenue Share (2.5% to 4.0%) with no capital or operating expenditure required, on a project which could simultaneously realise significant environmental improvements[6].

TUNGSTEN PROJECT (NT)

Molyhil Tungsten – Molybdenum-Copper Project – NT (75% Thor)

The Molyhil tungsten-molybdenum-copper deposit is 75% owned by Thor and is located 220km north-east of Alice Springs (320km by road) within the prospective polymetallic province of the Proterozoic Eastern Arunta Block in the Northern Territory.

The deposit consists of two adjacent outcropping iron-rich skarn bodies, the northern ‘Yacht Club’ lode and the ‘Southern’ lode. Thor executed an A$8m (Approx. £4m) Farm-in and Funding Agreement through a Heads of Agreement (HoA) with Investigator Resources Limited operating as Fram Ltd (Fram) (ASX: IVR) to accelerate exploration at the Molyhil Project on 24 November 2022. On 22 April 2024, Fram advised Thor in writing that it had met the Stage 1 expenditure requirement. The parties subsequently executed a Joint Venture (“JV”) Agreement on 13 August 2024, and Thor transferred to Fram a 25% interest in the Molyhil Tenements.

As part of the JV structuring, the original Molyhil exploration licence EL22349 was subdivided, creating new licence EL34050 and EL22349. EL34050 was subsequently sold to Sandover SPV1 Pty Ltd, a subsidiary of Tivan Ltd, with Molyhil/Fram and Tivan entering into a Mineral Sharing Agreement that ensures cross-tenement mineral rights are maintained where mineralisation extends across licence boundaries.

Post-period (September 2025), a Term Sheet was signed with Tivan Limited to sell the FRAM Joint Venture (Molyhil) for a total consideration of A$8,750,000 (Approximately £4,375,000), with Thor’s 75% share totalling A$6,562,500 (Approximately £3,281,250)[7].

A full background on the project is available on the Thor website.

JORC (2012) COMPLIANT MINERAL RESOURCES AND RESERVES

Table A: Alford East Mineral Resource Estimate (Reported 22 January 2021)

| Domain | Tonnes (Mt) | Cu % | Au g/t | Contained Cu (t) | Contained Au (oz) |

| AE_1 | 24.6 | 0.12 | 0.021 | 30,000 | 16,000 |

| AE_2 | 6.8 | 0.13 | 0.004 | 9,000 | 1,000 |

| AE_3 | 34.9 | 0.09 | 0.022 | 33,000 | 25,000 |

| AE_4 | 8.0 | 0.11 | 0.016 | 8,000 | 4,000 |

| AE_5 | 11.0 | 0.22 | 0.030 | 24,000 | 11,000 |

| AE-8 | 31.3 | 0.19 | 0.008 | 61,000 | 8,000 |

| AE-7 | 7.7 | 0.14 | 0.025 | 10,000 | 6,000 |

| AE-6 | 1.3 | 0.13 | 0.011 | 2,000 | 500 |

| Total | 125.6 | 0.14 | 0.018 | 177,000 | 71,500 |

Notes:

· Thor has an 80% interest in oxide material with Spencer Metals.

· MRE reported on oxide material only, at a cut-off grade of 0.05% copper which is consistent with the assumed ISR technique.

· Minor rounding errors may occur in compiled totals.

· The Company is not aware of any information or data which would materially affect this previously announced resource estimate, and all assumptions and technical parameters relevant to the estimate remain unchanged.

Table B: Alford West Copper Mineral Resource Estimate (Reported 15 August 2019)

| Resource Classification | COG (Cu %) | Deposit | Volume (Mm3) | Tonnes (Mt) | Cu (%) | Cu metal (tonnes) | Au (g/t) | Au (Oz) |

| Inferred | 0.05 | Wombat | 20.91 | 46.5 | 0.17 | 80,000 | ||

| Bruce | 5.51 | 11.8 | 0.19 | 22,000 | ||||

| Larwood | 3.48 | 7.8 | 0.15 | 12,000 | 0.04 | 10,000 | ||

| Total | 29.9 | 66.1 | 0.17 | 114,000 | ||||

Notes:

· EnviroCopper is earning a 75% interest in this resource, and Thor holds 24% equity in EnviroCopper.

· All figures are rounded to reflect the appropriate levels of confidence. Apparent differences may occur due to rounding.

· Cut-off grade used of 0.05% Cu.

· The Company is not aware of any information or data which would materially affect this previously announced resource estimate, and all assumptions and technical parameters relevant to the estimate remain unchanged.

Table C: Kapunda Resource Summary 2018 (Reported 12 February 2018)

| Resource | Copper | |||

| Mineralisation | Classification | MT | Grade % | Contained Cu (t) |

| Copper Oxide | Inferred | 30.3 | 0.24 | 73,000 |

| Secondary copper sulphide | Inferred | 17.1 | 0.27 | 46,000 |

| Total | 47.4 | 0.25 | 119,000 | |

Notes:

· EnviroCopper is earning a 75% interest in this resource, and Thor holds 24% equity in EnviroCopper.

· All figures are rounded to reflect the appropriate levels of confidence. Apparent differences may occur due to rounding.

· Cut-off of 0.05% Cu.

· The Company is not aware of any information or data which would materially affect this previously announced resource estimate, and all assumptions and technical parameters relevant to the estimate remain unchanged.

Table D: Molyhil Mineral Resource Estimate (Reported May 31, 2024)

| Classification | ‘000Tonnes | WO3 | Mo | Cu | |||

| Grade % | Tonnes | Grade % | Tonnes | Grade % | Tonnes | ||

| Measured | 1,160,000 | 0.34 | 3.900 | 0.13 | 1,300 | 0.06 | 700 |

| Indicated | 1,664,000 | 0.27 | 4,600 | 0.09 | 1,600 | 0.05 | 800 |

| Inferred | 1,823,000 | 0.20 | 3.600 | 0.12 | 1,500 | 0.03 | 550 |

| Total | 4,647,000 | 0.26 | 12,100 | 0.09 | 4,400 | 0.05 | 2,050 |

Notes:

· All figures are rounded to reflect the appropriate level of confidence. Apparent differences may occur due to rounding.

· Cut-off of 0.05% WO3.

· 75% owned by Thor Energy Plc, subject to further farm-in movements with Investigator Resources Limited.

· Certain tenements were sold during the current year. Refer to note 7 for further information.

· Subsequent to year end Thor has entered into an agreement to sell the remaining 75% of the interest.

· To satisfy the criteria of reasonable prospects for eventual economic extraction, the Mineral Resources have been reported down to 150 m RL which defines material that could be potentially extracted using open pit mining methods.

Table E: Natural Hydrogen and Helium Prospective Resource (Reported 31 March 2025)

| Unrisked Recoverable Prospective Resources on RSEL 802 | |||||||

| Hydrogen (Bcf) | Helium (Bcf) | ||||||

| 1U | 2U | 3U | 1U | 2U | 3U | ||

| RSEL 802 (net) | 275 | 1,050 | 3,511 | 25 | 115 | 427 | |

| Thor (net) | 221 | 842 | 2,816 | 20 | 90 | 343 | |

Notes:

· The estimated quantities of hydrogen and helium that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both a risk of discovery and a risk of development. Further exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially recoverable hydrogen and helium.

· The prospective resources are based on the entrapment model for natural hydrogen and helium in the free gas phase.

· The assessment was undertaken by RISC Advisory Pty Ltd.

Any information contained in this report that relates to Mineral or Prospective Resources has been extracted from a previously released announcements dated 12/02/2018, 26/11/218, 15/08/2019, 29/01/2020, 22/01/2022, 31/05/2024 and 31/03/2025 (“Announcements”). The Company confirms that it is not aware of any new information or data that materially affects the information included in the Announcements, and that all material assumptions and technical parameters underpinning the estimates in the Announcements continue to apply and have not materially changed.

CORPORATE

During the period, Nicole Galloway-Warland retired as Managing Director with immediate effect, eventually replaced by Mr Andrew Hume, a highly experienced global energy-sector executive based in Perth, Western Australia.

Mr Hume has a 27-year career in the energy sector, holding key roles in multinational companies. He commenced at Thales Group (previously known as Racal Electronics), advancing to Geosciences Manager, USA. At Shell and Murphy Oil Corp, he contributed to geoscience analysis, drilling, asset management, and portfolio growth. At Maersk Oil and Gas, he led regional new ventures before steering strategy and performance across exploration and appraisal. Following the acquisition by TotalEnergies, he led regional strategy, portfolio, planning and performance, before delivering business development, leading joint ventures and managing a multiparty decarbonisation and renewables project. Andrew’s career is marked by global experience and leadership across business and technical disciplines, principally in the USA, Australia, Denmark, and the UK.

He holds an Executive MBA with distinction from the University of Cambridge and BSc (Hons) Geology from the University of St. Andrews.

During the period, Mr. Hume assumed the combined role of CEO and Managing Director, allowing Alastair Clayton to transition from Executive Chairman to Non-Executive Chairman.

Additionally, Mr Lincoln Moore was appointed as a director following the resignation of Mark McGeogh. For the past 15 years, Mr. Moore has been actively involved in establishing and raising finance for mining and agriculture projects. Lincoln is the co-founder and corporate advisor of Firering Strategic Minerals plc which is in the process of commissioning the largest quicklime processing operation in Zambia. He also currently serves as an Executive Director of Ivory Coast based AIM-quoted, Dekel AgriVision plc, which produces palm oil and cashews, with primary responsibilities for the corporate finance activities of the organisation. Mr. Moore also previously served as a Director of the London Main market listed company, Dial Square Investments plc (now Energy Pathways plc), which is currently undertaking detailed feasibility to establish a hydrogen storage operation in the UK. Lincoln was a Senior Manager in the restructuring division of Deloitte Australia and London, with significant experience in operational and corporate restructuring. In connection to Lincoln’s appointment, Mr Rowan Harland was appointed Company Secretary following Mr Ray Ridges resignation.

Earlier in the year, the Company successfully raised £1,000,000 via a two-tranche placement that closed in December 2024.

During the year, the company completed the acquisition of 80.2% of white hydrogen and helium explorer Go Exploration Pty Ltd. Go Exploration holds one of only 3 granted hydrogen and helium exploration licences in South Australia (PEL 120) and strategic, high potential application areas covered by applications (PELAs 697 and 709). The acquisition was satisfied via the issue of 466,462,584 new ordinary shares in the Company following approval by members at the Company’s AGM.

The Company also relocated and closed its Adelaide office, changing its Australian postal address to Western Australia, as part of its operational streamlining.

The shift in strategic focus and subsequent asset rationalisation was intended to strengthen the balance sheet. The net cash outflow from Operating and Investing activities during the quarter ended 30 June 2025 was $548,000. The Company reported cash and cash equivalents of A$1,459,000 at 30 June 2025. Based on forecast net cash outflows, the estimated quarters of funding available at the end of the period was 2.66 quarters. The Board continues to rely on asset monetisation (Molyhil, US Uranium claims) and future equity funding, while maintaining close management of cash, for continued operations. Payments totalling $95,000 were made to Directors in the quarter ending 30 June 2025.

Comprehensive Income

The comprehensive income statement records a comprehensive loss of £8,280,000 (2024: £2,503,000 loss) after taking into account unrealised exchange loss of £839,000(2024: £30,000 loss). The loss for the period ended 30 June 2025 also included a £1,031,000 non-cash write down of the carrying value of the Group’s Ragged Range Project (note 7), £4.4m write-down of the Groups Molyhil project (note 7). The loss also includes a loss on disposal of £495,259 for the sub-division and part disposal of EL22349 tenement as well as the amalgamation and sale of MLS77, MLS78, MLS79, MLS80, MLS81, MLS82, MLS83, MLS84, MLS85 and MLS86 as well as £400,000 for its disposal of its 40% interest in the Bonya tenement. The write down reflects the Group’s decision to focus its available resources on its Alford East and Hydrogen projects (refer to Note 7 of the financial statements).

Principal risks and uncertainties

The management of the business and the execution of the Group’s strategy are subject to a number of risks. The key business risks affecting the Group are set out below.

Risks are formally reviewed by the Board, and appropriate processes are put in place to monitor and mitigate them. If more than one event occurs, it is possible that the overall effect of such events would compound the possible adverse effects on the Group.

Exploration risks

The exploration and mining business is controlled by a number of global factors, principally supply and demand which in turn is a key driver of global mineral prices; these factors are beyond the control of the Group. Exploration is a high-risk business and there can be no guarantee that any mineralisation discovered will result in proven and probable reserves or go on to be an operating mine. At every stage of the exploration process the projects are rigorously reviewed to determine if the results justify the next stage of exploration expenditure ensuring that funds are only applied to high-priority targets.

The principal assets of the Group comprising the mineral exploration licences are subject to certain financial and legal commitments. If these commitments are not fulfilled the licences could be revoked. They are also subject to legislation defined by the Government; if this legislation is changed it could adversely affect the value of the Group’s assets.

The Group’s Bonya tenement EL32167 is due for renewal on 5 November 2026. As at the date of this report, renewal applications are being prepared for the Bonya tenement. Based on the Group’s history of successful tenement renewals, the Directors have a reasonable expectation that these tenements will continue to be maintained as required for ongoing exploration activities.

The Group’s natural hydrogen and helium portfolio consists of its 80.2% ownership of Go Exploration (Purchase completed February 17th, 2025) and associated operatorship of all licences and licence applications contained within this portfolio. The portfolio consists of South Australian licences:

· Regulated Substance Exploration Licence (RSEL) 802 which provides exploration rights to explore for natural hydrogen and helium.

o The licence was awarded on March 26, 2025, derived from and inheriting the associated licence period and timeline of its former/progenitor licence – Petroleum Exploration Licence (PEL) 120. Specifically, RSEL 802 was awarded within the final year of the penultimate 5-year licence period, ending July 1st, 2025.

o All 2nd term 5-year licence period work commitments have been fulfilled, and the licence entered its 3rd and final 5-year licence period in July, 2025

· Gas Storage Exploration Licences (GSEL) 804, 805, and 805, provide gas storage exploration rights to determine the viability of short-term storage of gases such as hydrogen, helium, or natural gas, and the long-term sequestration of gases such as carbon dioxide. They provide a potential differentiator for natural hydrogen economic viability.

o These licences were awarded on June 23, 2025, derived from and inheriting the associated licence period and timeline of its former/progenitor licence – Petroleum Exploration Licence (PEL) 120. Specifically, the licences were awarded within the final year of the penultimate 5-year licence period, ending July 1st, 2025.

o All 2nd term 5-year licence period work commitments have been fulfilled, and the licences entered their 3rd and final 5-year licence period in July 2025

At the date of this report the renewal application has been submitted for RSEL 802 (on 16 June 2025) and GSEL’s 804, 805 and 806 (on 27 June 2025) to seek their continuation into the final 5-year licence period; the South Australian Government’s, Department of Energy and Mining (DEM) are currently reviewing the application. These licences continue by default and, based on the Group’s history of successful licence of renewals and through positive dialogue with DEM, the Directors have a reasonable expectation that these licences will continue into their final 5-year licence period, as required for ongoing exploration activities on the licence.

Dependence on key personnel

The Group and Company is dependent upon its executive management team and various technical consultants. Whilst it has entered into contractual agreements with the aim of securing the services of these personnel, the retention of their services cannot be guaranteed. The development and success of the Group depends on its ability to recruit and retain high-quality and experienced staff. The loss of the service of key personnel or the inability to attract additional qualified personnel as the Group grows could have an adverse effect on future business and financial conditions.

Uninsured risk

The Group, as a participant in exploration and development programmes, may become subject to liability for hazards that cannot be insured against or third-party claims that exceed the insurance cover. The Group may also be disrupted by a variety of risks and hazards that are beyond control, including geological, geotechnical and seismic factors, environmental hazards, industrial accidents, occupational and health hazards and weather conditions or other acts of God.

Funding risk

The only sources of funding currently available to the Group are through the issue of additional equity capital in the parent company or through bringing in partners to fund exploration and development costs. The Company’s ability to raise further funds will depend on the success of the Group’s exploration activities and its investment strategy. The Company may not be successful in procuring funds on terms which are attractive and, if such funding is unavailable, the Group may be required to reduce the scope of its exploration activities or relinquish some of the exploration licences held for which it may incur fines or penalties.

Financial risks

The Group’s operations expose it to a variety of financial risks that can include market risk (including foreign currency, price and interest rate risk), credit risk, and liquidity risk. The Group has a risk management programme in place that seeks to limit the adverse effects on the financial performance of the Group by monitoring levels of financial commitments. The Group does not use derivative financial instruments to manage interest rate costs and, as such, no hedge accounting is applied.

Section 172(1) Statement – Promotion of the Company for the benefit of the members as a whole

Section 172 of the Companies Act 2006 requires Directors to take into consideration the interests of stakeholders and other matters in their decision making. The Directors continue to have regard to the interests of the Group’s employees and other stakeholders, the impact of its activities on the community, the environment and the Group ‘s reputation for good business conduct, when making decisions and they are addressed in detail below:

| Stakeholders | Impact | Strategy & decision making |

| Employees | Thor recognises that an organisation in its life cycle relies heavily on a few key employees to determine the success of the Group. As the Group currently only employees Directors it aims to ensure that they are engaged and motivated. | It has put in place a remuneration committee that reviews the performance and salary of Directors annually to ensure they are properly remunerated. The Board believes that these processes will keep the current management engaged and attract high end talent to join the Group when/if opportunities arise. |

| Shareholders | Thor is committed to maintaining regular dialogue with shareholders and implementing apparatus that allows two-way communication. Through these communication channels it aims to deliver information on how the Directors are working towards the ultimate goal of delivering value to the shareholders | Acquisition of Go ExplorationDuring the year the Group acquired 80.2% of the share capital of Go Exploration. The Group believed that the potential in white hydrogen production will bring significant value to the Shareholders of the Company. Sale of non-core assetsDuring the year the Group has reviewed its current assets and has begun the process of streamlining its operations to focus on its core assets. During the current year, As part of this the Group has sold part of its Molyhil tenements and entered into a Joint Venture agreement to farm out 25% of the remaining interest as well as disposing of its 40% interest in EL 29701. Subsequent to year end the Group has sold 75% of its interest in its American Uranium and Vanadium projects. On top of this the Company has entered into a term sheet to sell the remainder of its Molyhil assets. The Board believes that this will free up significant capital to allocate to its Hydrogen site. |

| Governance | The Board is committed to maintaining the highest standard of governance within the Group including but not limited to: – Transparent decision-making processes – Strong internal controls to mitigate risk – Regular review of policies/processes to uphold best practices | The Board has processes in place specifically to oversee Governance being the audit Committee and remuneration committee that meet regularly throughout the year to oversee their designated portfolios. |

| Environmental | The Board is aware of the changing landscape in which the Group operates and must look to regularly assess and mitigate its environmental impact | The Group’s main environmental footprint occurs in Australia where operations occur. Operations are overseen by State Authorities and the Group complies with all necessary operational requirements. As the Group looks to expand it will monitor its environmental impact and take reasonable steps to mitigate any adverse impact where possible |

We aim to work responsibly with our stakeholders, including suppliers. The key Board decisions made during the period and post period end are set out in the Chairman’s and Chief Executive’s Statement.

Other information

Other information that is usually found in the Strategic report has been included in the Directors report.

This report was approved by the Board on 26 September 2025.

Andrew Hume

Managing Director and CEO

DIRECTORS’ REPORT

The Directors are pleased to present this year’s annual report together with the consolidated financial statements for the year ended 30 June 2025.

Review of Operations

The net result of operations for the year was a loss of £7,441,000 (2024 loss: £2,474,000). Comprehensive review of operations can be found on page 2 of this report.

Directors and Officers

The names and details of the Directors and officers of the company during or since the end of the financial year are:

| Alastair Clayton – Non-Executive Chairman |

| Andrew Hume – Managing Director and CEO (appointed 5 February 2025) |

| Tim Armstrong – Non-Executive Director |

| Lincoln Moore – Non-Executive Director (appointed 4 December 2024) |

| Nicole Galloway Warland – Managing Director (resigned 8 October 2024) |

| Mark McGeough – Non- Executive Director (resigned 4 December 2024) |

Alastair Clayton – Non-Executive Chairman

Mr Clayton is a financier and geologist, has over 25 years’ experience in the mining and exploration industry, identifying, financing and developing mineral, energy and materials processing projects in Australia, Europe and Africa. He was previously a Director of ASX100-list Uranium Developer Extract Resources where he represented major shareholder AIM-listed Kalahari Minerals on the Board. He was part of the team responsible for the eventual A$2.2B sale to CGNPC in 2012. He was also Chairman of ASX-listed Uranium Developer Bannerman Resources Limited and was a founding Director of ASX-listed Universal Coal which was sold to Terracom in 2021 for A$175m.

Andrew Hume – Managing Director and CEO (appointed 5 February 2025)

Mr Hume has a 27-year career in the energy sector, holding key roles in multinational companies. He commenced at Thales Group (previously known as Racal Electronics), advancing to Geosciences Manager, USA. At Shell and Murphy Oil Corp, he contributed to geoscience analysis, drilling, asset management, and portfolio growth. At Maersk Oil and Gas, he led regional new ventures before steering strategy and performance across exploration and appraisal. Following the acquisition by Total Energies, he led regional strategy, portfolio, planning and performance, before delivering business development, leading joint ventures and managing a multiparty decarbonisation and renewables project.

Andrew’s career is marked by global experience and leadership across business and technical disciplines, principally in the USA, Australia, Denmark, and the UK. He holds an Executive MBA with distinction from the University of Cambridge and BSc (Hons) Geology from the University of St. Andrews.

Tim Armstrong – Non-Executive Director

Mr Armstrong is an Institutional financial advisor at Prenzler Group, a Sydney based boutique advisory firm with an extensive institutional network across the broking and investment banking industries in Australia and abroad. He previously worked in financial PR in Australia and London, which entailed advising numerous listed and private companies on their corporate strategies predominantly in the resources sector. Tim is also a former professional sports person, spending five years as a first-class cricketer representing NSW, WA and Australia. He is currently Non- Executive Director at Cooper Metals Limited (ASX:CPM) and Charger Metals NL (ASX: CHR).

Lincoln Moore – Non-Executive Director (appointed 4 December 2024)

For the past 15 years, Mr. Moore has been actively involved in establishing and raising finance for mining and agriculture projects. Lincoln is the co-founder and corporate advisor of Firering Strategic Minerals plc which is in the process of commissioning the largest quicklime processing operation in Zambia. He also currently serves as an Executive Director of Ivory Coast based AIM-quoted, Dekel AgriVision plc, which produces palm oil and cashews, with primary responsibilities for the corporate finance activities of the organisation. Mr. Moore also previously served as a Director of the London Standard listed company, Dial Square Investments plc (now Energy Pathways plc), which is currently undertaking detailed feasibility to establish a hydrogen storage operation in the UK. Lincoln was a Senior Manager in the restructuring division of Deloitte Australia and London, with significant experience in operational and corporate restructuring.

Non-Executive Director Service contracts

All Non-Executive Directors are appointed under the terms of a letter of appointment. Each appointment provides for annual fees of A$60,000 (Approximately £30,000) for services as a Non-Executive Director, inclusive of the 11.0% statutory superannuation scheme (11.5% from 1 July 2025) applicable to Australian Directors. The agreement allows that any services supplied by the Non- Executive Directors to the Company and any of its subsidiaries in excess of two days in any calendar month, may be invoiced to the Company at market rate, currently at A$1,000(£500) per day.

Principal activities and review of the business

The principal activities of the Group are the exploration for and potential development of gold, copper, uranium, vanadium, tungsten and other mineral deposits, with a focus on Hydrogen and Helium assets that are crucial in the shift to a ‘green’ energy economy.

The Group’s existing exploration project portfolio comprises:

· During the Company year the Group acquired 80.2% of the share capital of Go Exploration Pty Ltd. The Project holds the PEL 120 exploration licence which will be used to explore for Hydrogen and Helium reserves in South Australia.

· 100% owned mineral claims in the US states of Colorado and Utah within the Uravan Mineral Belt, with historical high-grade uranium and vanadium production results. Subsequent to year end the Group disposed of 75% of its interest in the projects to Metals One Plc.

· Thor has an 80% interest in the Alford East Copper-Gold Project in South Australia. The project contains copper-gold oxide mineralisation considered amenable to extraction via In Situ Recovery techniques. Alford East has an Inferred Mineral Resource Estimate of 177,000 tonnes contained copper & 71,500 oz of contained gold.

· Thor holds a 24% investment in EnviroCopper Limited. ECL holds 1) an agreement to earn, in two stages, up to 75% of the rights over metals which may be recovered via In-Situ Recovery contained in the Kapunda deposit, with in-ground lixiviant trials now underway and copper recoveries to be reported in 2025, and 2) an agreement with Andromeda Metals to acquire the Alford West EL 5984 tenement.

· The Company has an Agreement with ASX-listed mineral exploration and development company Investigator Resources Limited (ASX: IVR, “IVR”), to fund the accelerated exploration of Thor’s 100% owned Molyhil tenements, whereby IVR has the right to earn, via a three-stage process, up to an 80% interest in the Molyhil tenements. During the current year, following the achievement of its stage 1 expenditure commitments, a joint venture agreement was executed and IVR received a 25% interest in the tenements from Thor. At the date of this report, Thor now holds a 75% interest in the remaining Molyhil tenements. Under the terms of the agreement Molyhil and IVR (Via its wholly owned subsidiary Fram Limited) will hold the legal and beneficial title to the JV Tenements and may explore exclusively for all minerals other than fluorite and calcium fluorite (CaF₂). During the year the Company and IVR subdivided tenement EL 22349 which was then sold to Sandover SPV1 Pty Ltd, a wholly owned subsidiary of Tivan Limited along with MLs77,78,79,80,81,82,83,84,85 & 86. Subsequent to year end the Group entered into an agreement to sell its remaining interest in the Molyhil tenements. Refer to note 21 for further information.

Business Review and future developments

A review of the current and future development of the Group’s business is provided in the Review of Operations & Strategic Report.

Results and dividends

The Group incurred a loss after taxation of £7,441,000 (2024 loss: £2,474,000). No dividends have been paid or are proposed.

Key Performance Indicators

Given the nature of the business and that the Group is in the exploration and development phase of operations, the Directors are of the opinion that analysis using KPIs is not appropriate for an understanding of the development, performance or position of our businesses at this time.

At this stage, management believe that the carrying value of exploration assets and the management of cash is the main performance indicator which is monitored closely to ensure the group has sufficient funds to advance its exploration assets.

Events occurring after the reporting period

Refer to note 21 for subsequent events.

Substantial Shareholdings

As at 18 September 2025, the Company had last been notified by two shareholders with an interest in 3% or more of the nominal value of the Company’s shares:

· On 21 February 2025, the Company lodged a substantial holder notice received from Ross Warner, Black Lantern Investments Pty Ltd atf Signal Super Fund, noting an interest of 135,496,275 Ordinary Shares (held as CDIs) being 13.50% in the total ordinary shares on issue at that time.

· On 21 February 2025, the Company lodged a substantial holder notice received from Trent Spry, Brian Vivian SPRY & Trent Benjamin SPRY atf The Spry Superannuation Fund, noting an interest of 135,496,274 Ordinary Shares (held as CDIs) being 13.50% in the total ordinary shares on issue at that time.

Directors & Officers Shareholdings

The Directors and Officers who served during the period and their interests in the share capital of the Company at 30 June 2025 or their date of resignation if prior to 30 June 2025, were follows:

| Ordinary Shares/Chess depository interests (CDIs) | Options/Performance Shares | |||||

| 30 June 2025 | 30 June 2024 | 30 June 2025 | 30 June 2024 | |||

| Alastair Clayton | 18,192,308 | 7,692,308 | 29,464,154 | 5,146,154 | ||

| Andrew Hume 1 | – | – | 45,000,000 | – | ||

| Tim Armstrong | 4,500,000 | – | 10,500,000 | – | ||

| Lincoln Moore 2 | 1,333,333 | – | – | – | ||

| Nicole Galloway Warland 3 | 1,325,000 | 1,325,000 | 3,700,000 | 3,700,000 | ||

| Mark McGeough 4 | 255,032 | 255,032 | 1,300,000 | 1,300,000 | ||

1- Appointed 4th February 2025

2- Appointed 4th December 2024

3- Resigned 8th October 2024

4- Resigned 4th December 2024

Directors’ Remuneration

The remuneration arrangements in place for directors and other key management personnel of Thor Energy Plc, are outlined below.

The Company remunerates the Directors at a level commensurate with the size of the Company and the experience of its Directors. The Board has reviewed the Directors’ remuneration and believes it upholds the objectives of the Company with regard to this issue. Details of the Director emoluments and payments made for professional services rendered are set out in Note 4 to the financial statements.

The Australian-based Directors are paid on a nominal fee basis of A$60,000 (Approximately £30,000) per annum, and UK-based Directors are paid the GBP equivalent of A$50,000 at an agreed average foreign exchange rate, with the exception of Ms Nicole Galloway Warland who received a salary in her respective executive role, no further fees were payable to Ms Galloway Warland as Executive Director. For the period of 1 October 2024 to 30 June 2025 Alastair Clayton was paid a salary of A$200,000 (Approximately £100,000) in recognition of his executive role. From 1 July 2025 onwards he has moved to £50,000 per year.

Directors and Officers

Summary of amounts paid to Key Management Personnel

The following table discloses the compensation of the Directors and the key management personnel of the Group during the year. Further information can be found in Notes 4 and 16 of the annual financial statements.

| 2025 | Salary and Fees | Post Employment Super | Total Fees for Services rendered |

| £’000 | £’000 | £’000 | |

| Directors | |||

| Alastair Clayton | 102 | – | 102 |

| Nicole Galloway Warland 1 | 64 | 7 | 71 |

| Mark McGeough 2 | 13 | – | 13 |

| Tim Armstrong | 28 | – | 28 |

| Lincoln Moore 3 | 18 | – | 18 |

| Andrew Hume 4 | 54 | 6 | 60 |

| Key Personnel | |||

| Ray Ridge 5 | 22 | – | 22 |

| 2025 Total | 301 | 13 | 314 |

1- Resigned 8th October 2024

2- Resigned 4th December 2024

3- Appointed 4th December 2024

4- Appointed 5th February 2025

5- Resigned 4th December 2024

| 2024 | Salary and Fees | Post Employment Super | Total Fees for Services rendered |

| £’000 | £’000 | £’000 | |

| Directors | |||

| Alastair Clayton | 30 | – | 30 |

| Nicole Galloway Warland | 118 | 13 | 131 |

| Mark McGeough | 30 | 3 | 33 |

| Tim Armstrong1 | 3 | – | 3 |

| Key Personnel | |||

| Ray Ridge | 30 | – | 30 |

| 2024 Total | 211 | 16 | 227 |

1 Appointed 16 May 2024

Directors Meetings

The Directors hold meetings on a regular basis, and special meetings as required, to deal with items of business from time to time. Meetings held and attended by each Director during the year of review were:

| 2025 | Meetings held whilst in Office | Meetings attended |

| Alastair Clayton | 3 | 3 |

| Nicole Galloway Warland | 2 | 2 |

| Mark McGeough | 2 | 2 |

| Tim Armstrong | 3 | 3 |

| Lincoln Moore | 1 | 1 |

| Andrew Hume | 1 | 1 |

Corporate Governance

The Board have chosen to apply the ASX Corporate Governance Principles and Recommendations (ASX Corporate Governance Council, 4th Edition) as the Company’s chosen corporate governance code for the purposes of AIM Rule 26. Consistent with ASX listing rule 4.10.3 and AIM rule 26, this document details the extent to which the Company has followed the recommendations set by the ASX Corporate Governance Council during the reporting period. A separate disclosure is made where the Company has not followed a specific recommendation, together with the reasons and any alternative governance practice, as applicable. This information is reviewed annually.

The Company does not have a formal nomination committee, however it does formally consider board succession issues and whether the board has the appropriate balance of skills, knowledge, experience, and diversity. This evaluation is undertaken collectively by the Board, as part of the annual review of its own performance.

Whilst a separate Remuneration Committee has not been formed, the Company undertakes alternative procedures to ensure a transparent process for setting remuneration for Directors and Senior staff, that is appropriate in the context of the current size and nature of the Company’s operations. The full Board fulfils the functions of a Remuneration Committee, and considers and agrees remuneration and conditions as follows:

· All Director Remuneration is set against the market rate for Independent Directors for ASX- listed companies of a similar size and nature.

· The financial package for the Managing Director is established by reference to packages prevailing in the employment market for executives of equivalent status both in terms of level of responsibility of the position and their achievement of recognised job qualifications and skills.

The Company does not have a separate Audit Committee or Risk Committee; however, the Company undertakes alternative procedures to verify and safeguard the integrity of the Company’s corporate reporting and risk management processes, that are appropriate in the context of the current size and nature of the Company’s operations, including:

· The full Board, in conjunction with the Australian Company Secretary, fulfils the functions of an Audit Committee and is responsible for ensuring that the financial performance of the Group is properly monitored and reported.

· In this regard, the Board is guided by a formal Audit Committee Charter which is available on the Company’s website at https://thorenergyplc.com/about-us/#corporate-governance. The Charter includes consideration of the appointment and removal of external auditors, and partner rotation.

Further information on the Company’s corporate governance policies is available on the Company’s website www.thorenergyplc.com.

Environmental Responsibility

The Company is aware of the potential impact that its subsidiary companies may have on the environment. The Company ensures that it and its subsidiaries at a minimum comply with the local regulatory requirements with regards to the environment.

Employment Policies

The Group will be committed to promoting policies which ensure that high-calibre employees are attracted, retained and motivated, to ensure the ongoing success of the business. Employees and those who seek to work within the Group are treated equally regardless of gender, age, marital status, creed, colour, race or ethnic origin.

Health and Safety

The Group will aim to achieve and maintain a high standard of workplace safety. To achieve this objective, the Group will provide training and support to employees and set demanding standards for workplace safety.

Payment to Suppliers

The Group’s policy is to agree terms and conditions with suppliers in advance; payment is then made in accordance with the agreement provided the supplier has met the terms and conditions. Under normal operating conditions, suppliers are paid within 60 days of receipt of invoice.

Political Contributions and Charitable Donations

During the period the Group did not make any political contributions or charitable donations.

Annual General Meeting (“AGM”)

This report and financial statements will be presented to shareholders for their approval at the AGM. The Notice of the AGM will be distributed to shareholders together with the Annual Report.

Auditors

A resolution to reappoint PKF Littlejohn LLP will be considered at the Company’s next Annual General Meeting expected to be held in, or prior to, November 2025.

Statement of disclosure of information to auditors

As at the date of this report, the serving Directors confirm that:

· So far as each Director is aware, there is no relevant audit information of which the Group and Parent Company’s auditors are unaware, and

· They have taken all the steps that they ought to have taken as a Director in order to make themselves aware of any relevant audit information and to establish that the Group’s and Parent Company’s auditors are aware of that information.

Going Concern

The Directors note the losses that the Group has made for the Year Ended 30 June 2025. The Directors have prepared cash flow forecasts for the period ending 30 September 2026 which take account of the current cost and operational structure of the Group.

The cost structure of the Group comprises a high proportion of discretionary spend and therefore in the event that cash flows become constrained, some costs can be reduced to enable the Group to operate with a lower level of available funding. As a junior exploration company, the Directors are aware that the Company must go to the marketplace to raise cash to meet its exploration and development plans, and/or consider liquidation of its investments and/or assets as is deemed appropriate.

The Directors expect that further funds can be raised, and it is appropriate to prepare the financial statements on a going concern basis, however, there can be no certainty that any fundraise will be completed. These conditions indicate existence of a material uncertainty related to events or conditions that may cast significant doubt about the Group’s ability to continue as a going concern, and, therefore, that it may be unable to realise its assets and discharge its liabilities in the normal course of business. These financial statements do not include the adjustments that would be required if the Group could not continue as a going concern.

Statement of Directors’ Responsibilities

The Directors are responsible for preparing the financial statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare group and parent company financial statements for each financial year. Under that law the Directors have prepared the group and parent company financial statements in accordance with and UK-adopted international accounting standards. Under company law the Directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the group and parent company and of the profit or loss of the group and the parent company for that period. In preparing those financial statements, the Directors are required to:

· select suitable accounting policies and then apply them consistently;

· make judgments and accounting estimates that are reasonable and prudent;

· state whether applicable UK-adopted international accounting standards have been followed, subject to any material departures disclosed and explained in the financial statements; and

· prepare the financial statements on the going concern basis unless it is inappropriate to presume that the group and the parent company will continue in business.

The Directors confirm that they have complied with the above requirements in preparing the financial statements.

The Directors are responsible for keeping adequate accounting records that are sufficient to show and explain the Company transactions and disclose with reasonable accuracy at any time the financial position of the Company and enable them to ensure that the financial statements comply with the Companies Act 2006. They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection of fraud and other irregularities.

Electronic communication

The maintenance and integrity of the Company’s website is the responsibility of the Directors: the work carried out by the auditors does not involve consideration of these matters and, accordingly, the auditors accept no responsibility for any changes that may have occurred to the financial statements since they were initially presented on the website.

The Company’s website is maintained in accordance with AIM Rule 26.

Legislation in the United Kingdom governing the preparation and dissemination of the financial statements may differ from legislation in other jurisdictions.

This report was approved by the Board on 26 September 2025.

Alastair Clayton

Non-Executive Chairman