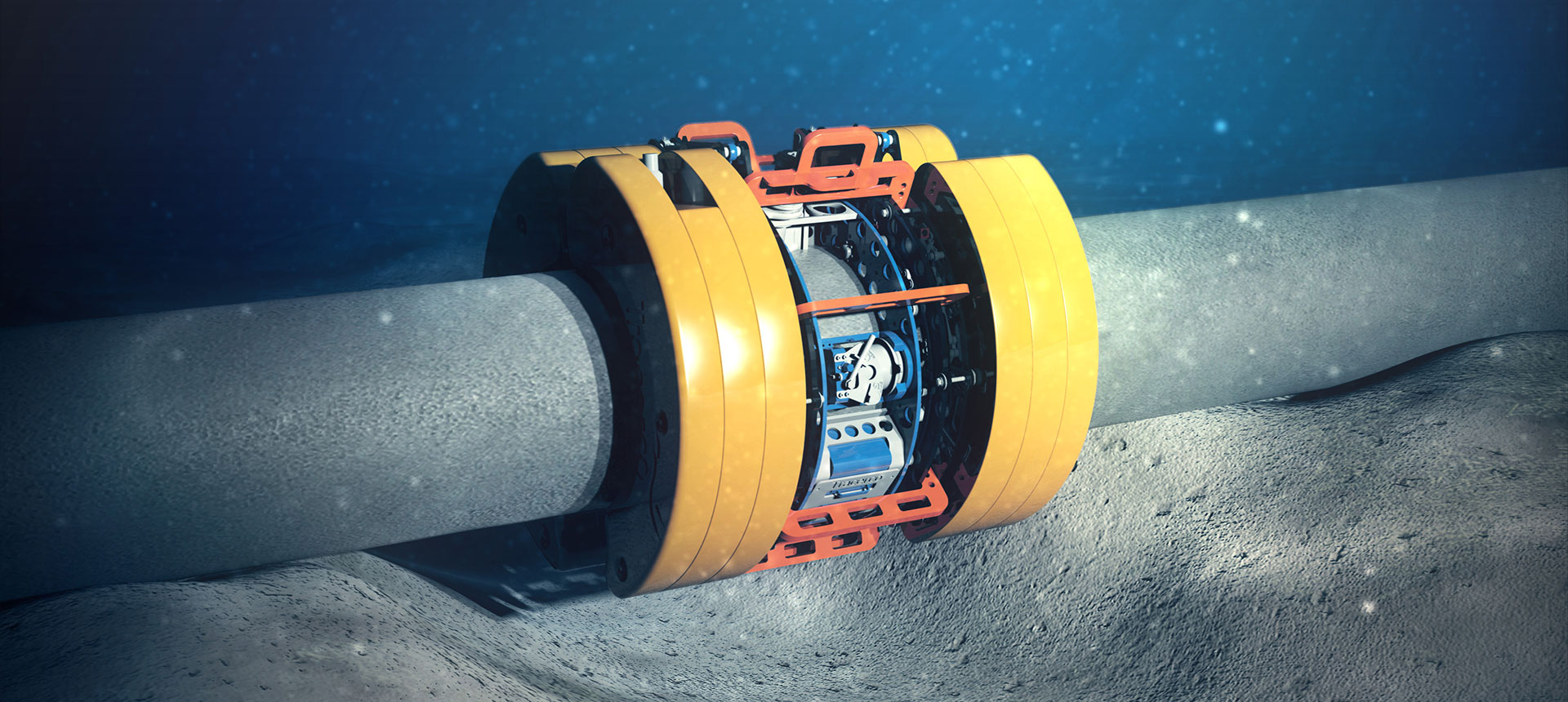

Johnson Matthey plc (LON:JMAT) has announced the sale of Diagnostic Services, a business providing specialised detection, diagnostic, and measurement solutions. Diagnostic Services is a part of JM’s Value Businesses and has been identified as non-core to JM’s growth strategy.

· Johnson Matthey announces the sale of Diagnostic Services to Sullivan Street Partners and Souter Investments for £55 million in cash

· Completion expected in the third quarter of 2023

· Execution of the divestment programme is on track to deliver targeted proceeds of at least £300 million by 31st March 2024

Diagnostic Services will be sold to Sullivan Street Partners, a UK based European mid-market private equity investor that has partnered with long term investor, Souter Investments, a Scottish based private family investment office, for £55 million. Sale proceeds are payable in cash at completion which is subject to customary completion conditions. Completion is expected in the third quarter of calendar 2023.

In the year ending 31st March 2022, Diagnostic Services reported external sales of £55 million, operating profit of £4 million and net assets of £35 million. A small accounting loss on sale is expected.

The divestment of Diagnostic Services is another transaction which progresses the delivery of one of JM’s strategic milestone commitments, to complete the divestment of Value Businesses by 31st March 2024.

Note: Johnson Matthey’s Diagnostic Services business is also known as “Tracerco”.