Drax Group plc (LON:DRX) is well positioned for a future increasingly dependent on renewable energy sources says Gervais Williams, Co-Fund Manager of the Diverse Income Trust plc (LON:DIVI), in an exclusive interview with DirectorsTalk.

DirectorsTalk asked:

In the energy sector Drax Group is the largest provider of new renewable power by output in the UK and it delivered a very strong and profitable financial performance in 2023. Now, they aim to be a world leader in carbon removals, how do you see their future outlook and earnings potential?

Gervais Williams of Diverse Income Trust commented:

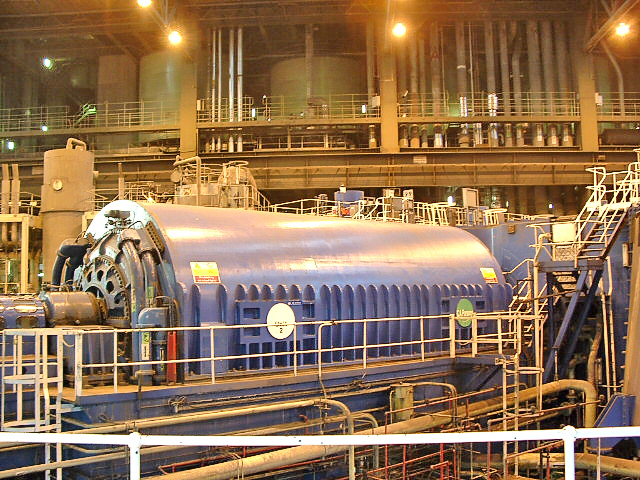

The good thing about Drax is they’ve invested: they are pretty much one of the leading power stations in terms of renewable sources of energy. I think we’ve all got to go that way. I think the advantages of having invested earlier rather than later will become more apparent.

Clearly, there’s a lot of anxiety about how governments will support this area and what the exact details are. Perhaps the details of the government’s decisions in this area have been a bit slower than people thought. The share price has been a bit overlooked for that reason.

Most particularly, the key is they’ve invested – they are already well positioned for the future and at some stage I think that will become more recognised. We’re pretty upbeat about Drax Group actually going forward.