Gresham House Strategic plc (LON: GHS) is an independent, AIM-quoted investment company that invests primarily in smaller UK public companies.

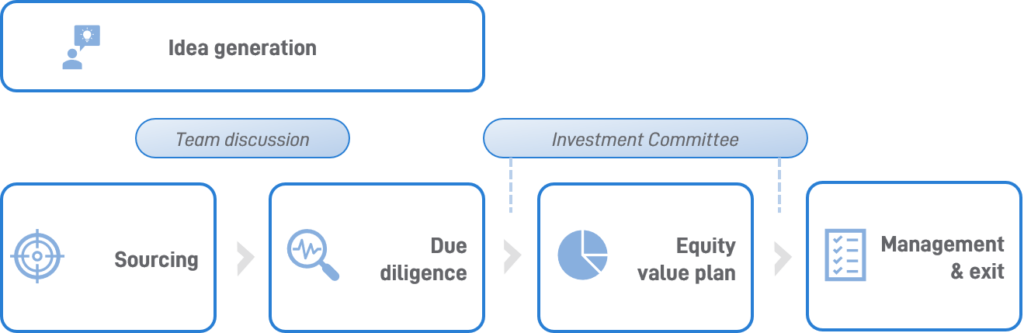

The team applies private equity techniques, constructive engagement and due diligence alongside a long-term value investment strategic equity investment philosophy.

Why invest

Their proprietary Strategic Equity strategy combines the approach and disciplined processes of private equity, with constructive corporate engagement and thorough due diligence. Their experience in this area has shown the potential for strong returns. The team can invest in a number of ways to help companies achieve their goals, including:

- Providing primary capital

- Supporting changes in strategic focus or operational performance

- Pre-IPO funding

- Providing a catalyst for M&A

Investment approach

Through their Strategic Public Equity investment philosophy, the company aims to have a considerably higher level of engagement with our investee company stakeholders, in order to exploit market inefficiencies and support a clear plan to create value over the long term.