Aferian plc (LON:AFRN) is a new breed of Media Tech business, focused on enabling operators to meet the challenge of the rapidly converging worlds of broadcast and next-generation streaming services.

Company overview

Mission: To become the leading innovator and trusted partner in delivering agile, effective and industry-leading video entertainment experiences.

GROUP OPERATING COMPANIES

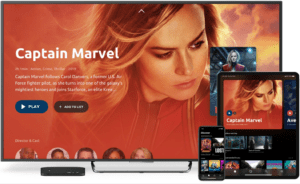

Aferian plc has two operating companies: 24i, which focusses on streaming video experiences and Amino, which connects Pay TV to streaming services. Our two complementary companies combine their products and services to create an industry-leading end-to-end offering to ensure that each viewer gets their TV programmes how and when they want it.

24i offers a robust technology platform that streams TV and video programming to any type of screen. The company has a 10-year market-leading position and works with customers like NPO, KPN, Delta Fiber and Broadway HD.

Amino seamlessly connects Pay TV to streaming services and provides the features required in a multiscreen entertainment world. The company has a 20-year heritage with customers like PCCW, Cincinnati Bell, T-MobileNL and Entel.