Argentex Group plc (LON:AGFX) service led, tech enabled provider of currency management and payment services to international institutions and corporates.

On 25 June 2019 the company listed on the London Stock Exchange AIM.

The pedigree of asset managers, pension funds, investment banks and family offices that have since invested in Argentex is testament to our robust business model and experienced leadership team.

CURRENCY RISK MANAGEMENT

Make informed decisions

Every company is unique. Your dedicated currency specialist will take the time to understand your business’ objectives and define informed hedging strategies that will help you manage the impact of currency volatility on your budget.

- Work with your dedicated specialist, who has over ten years of experience managing currency risk

- Treasury Policy Creation: take advantage of our expertise in developing and consulting on treasury policies to improve your approach to managing currency risk

Managing currency impact with effective hedging strategies

Access customised hedging strategies and a broad product portfolio to help you achieve the goals within your risk management framework or treasury policy.

- Spot Trades: achieve competitive rates for immediate transactions

- Forward Contracts: lock in a rate today for exchange on a specific date up to four years ahead, depending on your requirements

- Market Orders: enhance your hedging strategy by using market orders to buy and sell currencies when the market hits your desired rate

- FX Options: structured hedging solutions for clients with various risk profiles, offering both premium based and zero cost alternatives

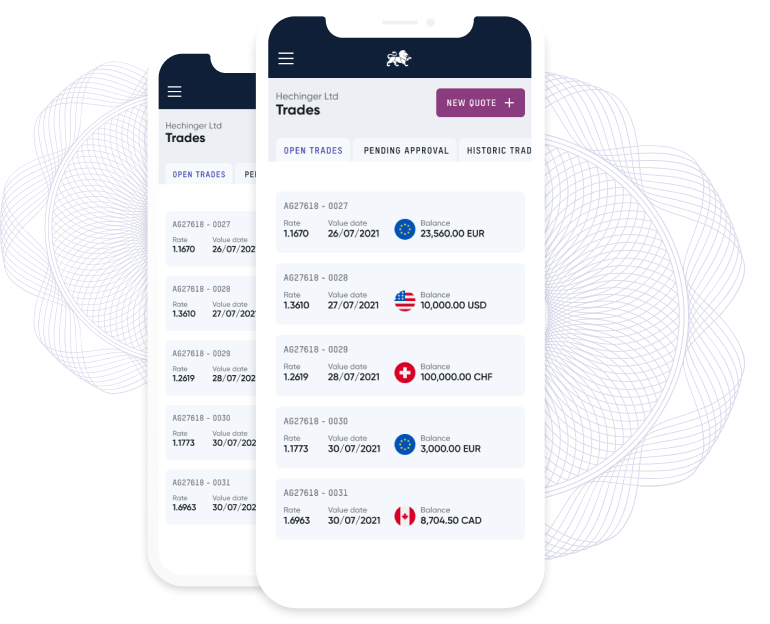

ALTERNATIVE TRANSACTION BANKING

15 currencies with one account number

Send, receive and hold payments from your international customers, partners, employees and suppliers at competitive market rates. Get multi-currency accounts in your organisation’s name for all your corporate entities, that can hold and receive funds like a traditional bank account.

- Fast onboarding, including compliance checks within 5-10 working days

- Accounts for 15 currencies

- Global payments in 140 currencies with market leading execution and pricing

Convenient, single-platform account management

Gain full visibility of your balances and transaction history, while benefiting from fast and flexible same-day payments. Your multi-currency account is instantly updated each time you make a transaction.

- Full reporting capabilities including event notifications, statements, payment management and app authorisations

- Secure multi-approval structure

- Access your account from anywhere, at any time